Plenty of Buyers Are Still Active Today [INFOGRAPHIC]

Some Highlights

- Holding off on selling your house because you believe there aren’t any buyers out there?

- Data shows buyers are still active, even with higher mortgage rates. This goes to show, people still want to buy homes, and those who can are moving now.

- Don’t delay your plan to sell for fear no one is buying. The opposite is true and buyer traffic is still strong today.

Why is it so hard to find a house to buy?

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.

There aren’t enough homes available for sale, but that shortage isn’t just a today problem. It’s been a challenge for years. Let’s take a look at some of the long-term and short-term factors that have contributed to this limited supply.

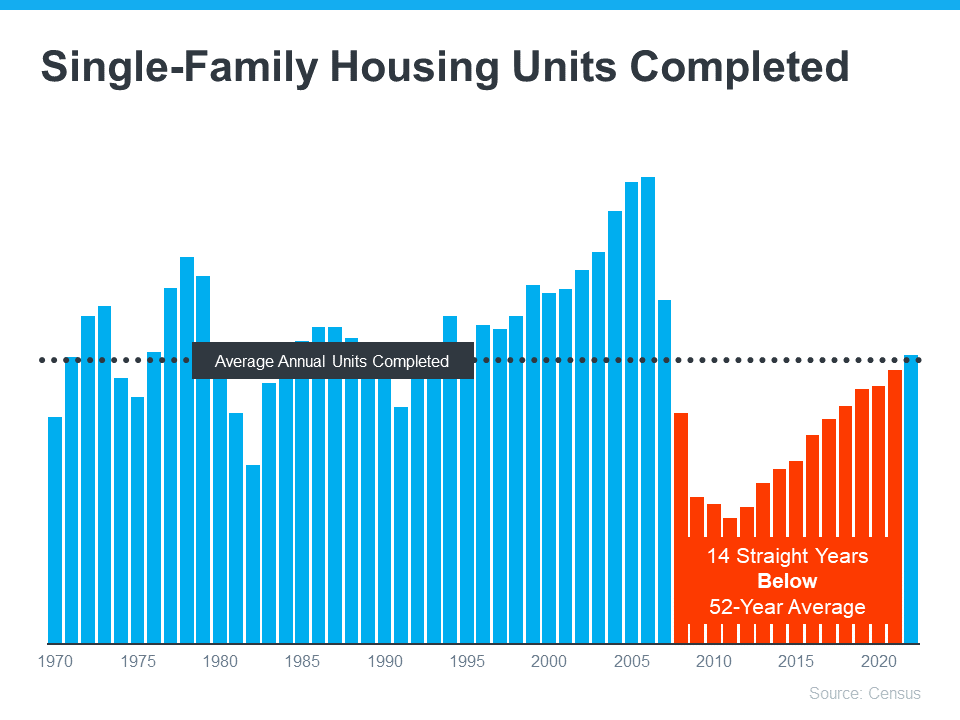

Why is it so hard to find a house to buy? Underbuilding Is a Long-Standing Problem

One of the big reasons inventory is low is because builders haven’t been building enough homes in recent years. The graph below shows new construction for single-family homes over the past five decades, including the long-term average for housing units completed:

For 14 straight years, builders didn’t construct enough homes to meet the historical average (shown in red). That underbuilding created a significant inventory deficit. And while new home construction is back on track and meeting the historical average right now, the long-term inventory problem isn’t going to be solved overnight.

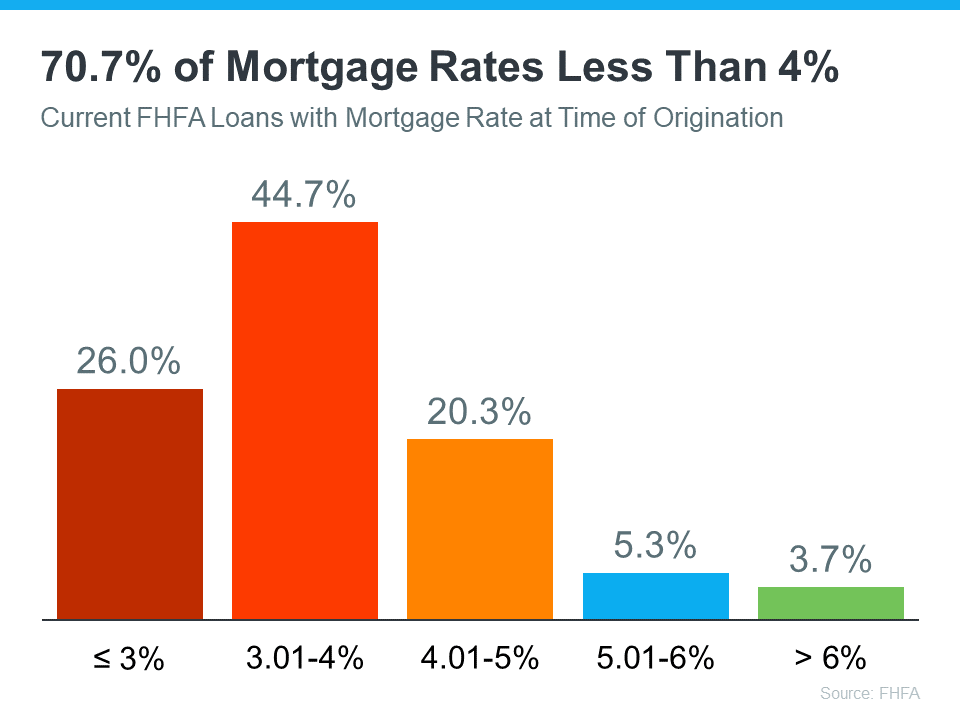

Today’s Mortgage Rates Create a Lock-In Effect

There are also a few factors at play in today’s market adding to the inventory challenge. The first is the mortgage rate lock-in effect. Basically, some homeowners are reluctant to sell because of where mortgage rates are right now. They don’t want to move and take on a rate that’s higher than the one they have on their current home. The chart below helps illustrate just how many homeowners may find themselves in this situation:

Those homeowners need to remember their needs may matter just as much as the financial aspects of their move.

Misinformation in the Media Is Creating Unnecessary Fear

Another thing that’s limiting inventory right now is the fear that’s been created by the media. You’ve likely seen the negative headlines calling for a housing crash, or the ones saying home prices would fall by 20%. While neither of those things happened, the stories may have dinged your confidence enough for you to think it’s better to hold off and wait for things to calm down. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

That’s further limiting inventory because people who would make a move otherwise now feel hesitant to do so. But the market isn’t doom and gloom, even if the headlines are. An agent can help you separate fact from fiction.

How This Impacts You

If you’re wondering how today’s low inventory affects you, it depends on if you’re selling or buying a home, or both.

- For buyers: A limited number of homes for sale means you’ll want to seriously consider all of your options, including various areas and housing types. A skilled professional will help you explore all of what’s available and find the home that best fits your needs. They can even coach you through casting a broader net if you need to expand your search.

- For sellers: Today’s low inventory actually offers incredible benefits because your house will stand out. A real estate agent can walk you through why it’s especially worthwhile to sell with these conditions. And since many sellers are also buyers, that agent is also an essential resource to help you stay up to date on the latest homes available for sale in your area so you can find your next dream home.

Bottom Line

The low supply of homes for sale isn’t a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit.

Planning to Retire? Your Equity Can Help You Make a Move

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why.

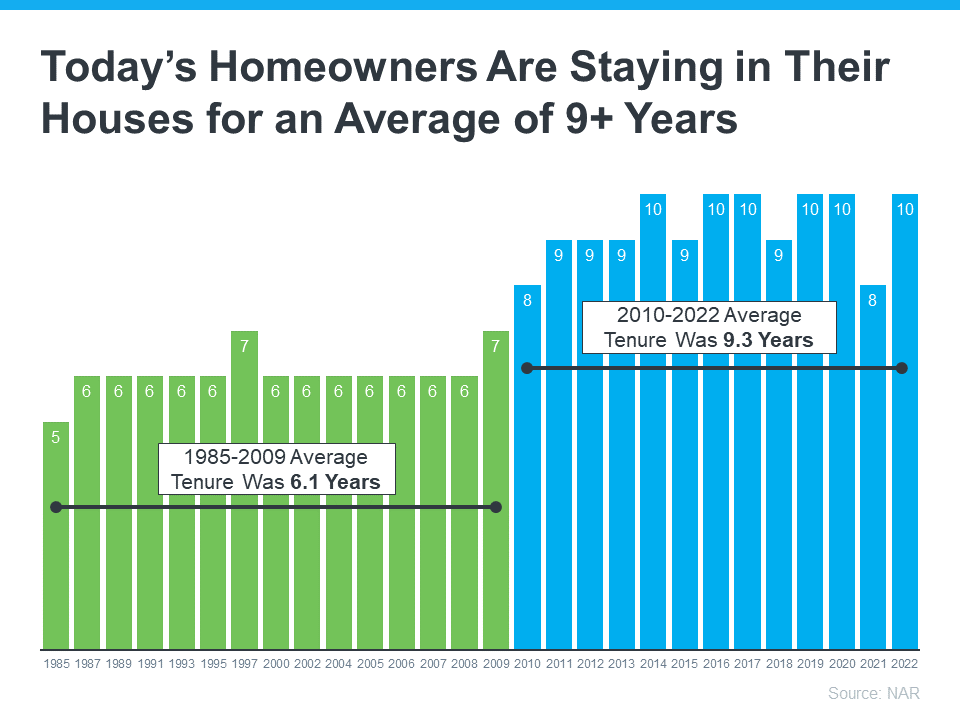

Consider How Long You’ve Been in Your Home

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to the National Association of Realtors (NAR), that number is higher today. Since 2010, the average home tenure is just over nine years (see graph below):

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

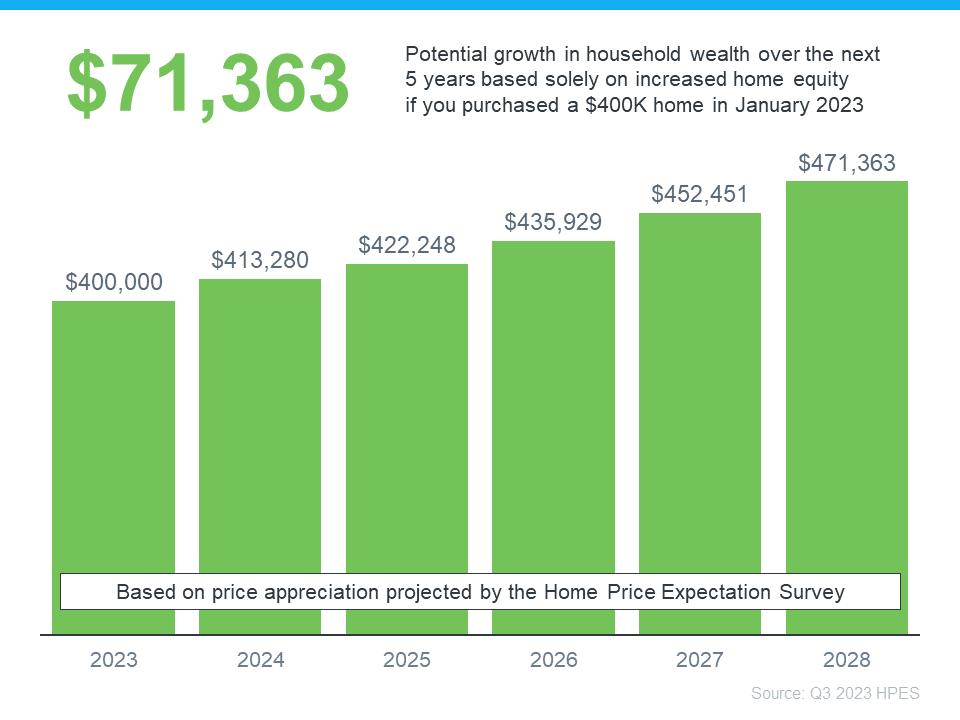

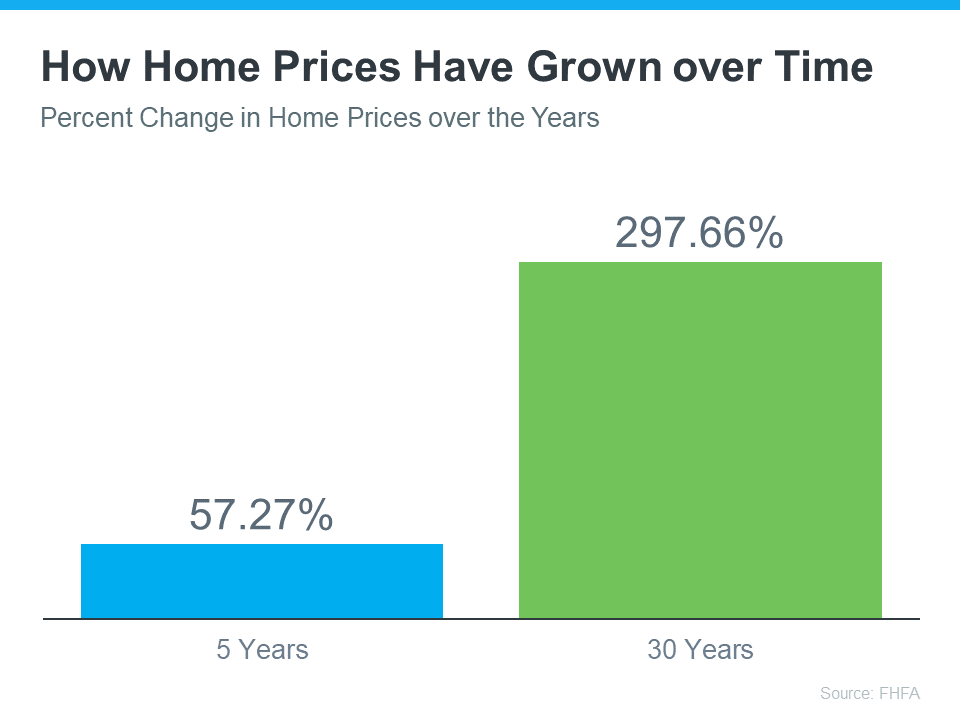

Consider the Equity You’ve Gained

And, if you’ve been in your home for more than a few years, you’ve likely built up substantial equity that can fuel your next move. That’s because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you’ve been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to friends or loved ones, that equity can help. Whatever your home goals are, a trusted real estate agent can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

Bottom Line

As you plan for your retirement, reach out to your trusted real estate advisor so you can find out how much equity you’ve built up over the years and plan how you can use it toward the purchase of a home that fits your changing needs.

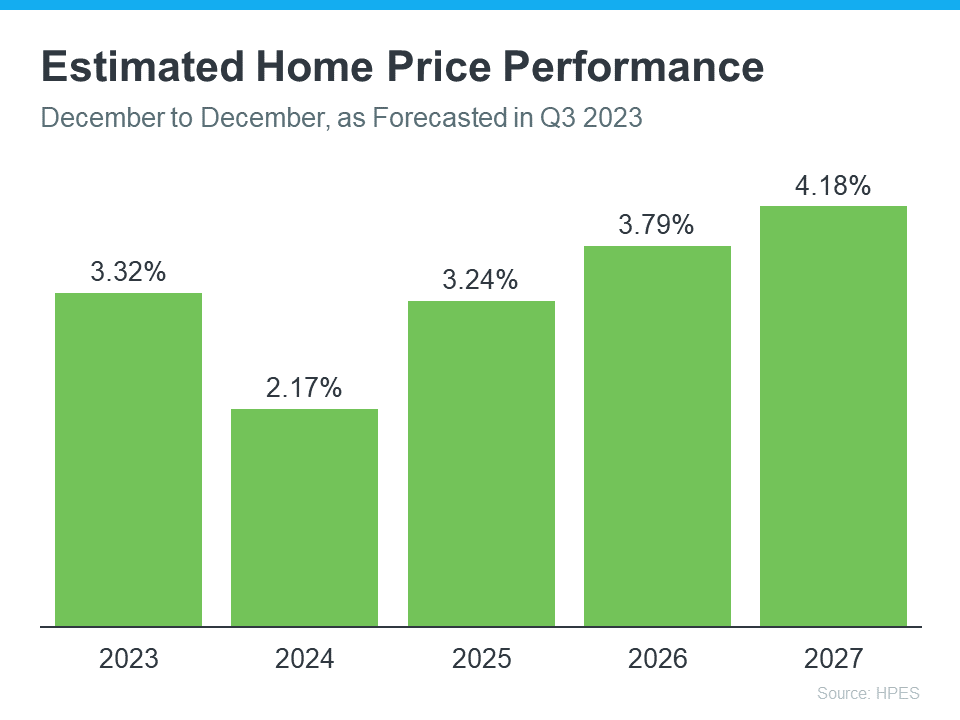

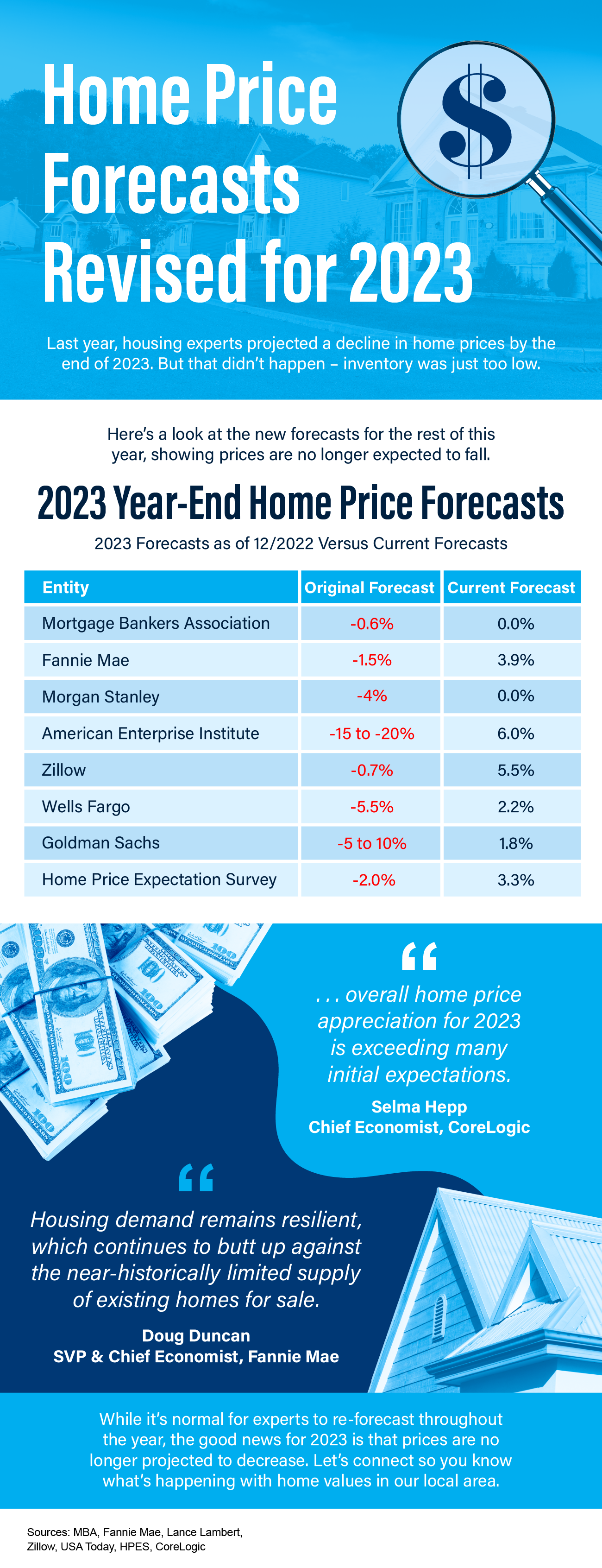

Home Price Forecasts Revised for 2023 [INFOGRAPHIC]

Some Highlights

- Last year, some housing experts projected a decline in home prices by the end of 2023. But that didn’t happen – inventory was just too low.

- While it’s normal for experts to re-forecast throughout the year, the good news for 2023 is that prices are no longer projected to decrease.

Sources

- https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/mortgage-finance-forecast-dec-2022.pdf

- https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-aug-2023.pdf

- https://www.fanniemae.com/media/45801/display

- https://www.fanniemae.com/media/48726/display

- https://twitter.com/NewsLambert/status/1671900591113609216 (Morgan Stanley)

- https://twitter.com/NewsLambert/status/1671556169712672768 (AEI)

- https://www.zillow.com/research/data/

- https://www.zillow.com/research/housing-market-challenges-32923/

- https://ustoday.news/a-20-drop-in-house-prices-7-forecast-models-tend-to-crash-here-the-other-13-models-show-the-housing-market-in-2023/ (Wells Fargo)

- https://twitter.com/NewsLambert/status/1686959362563092480 (Wells Fargo)

- https://twitter.com/NewsLambert/status/1691799764466008217 (Goldman Sachs)

- https://pulsenomics.com/surveys/#home-price-expectations

- https://www.corelogic.com/intelligence/us-corelogic-sp-case-shiller-index-down-by-0-5-year-over-year-in-may-but-a-turning-point-may-be-ahead/

- https://view.e.fanniemae.com/?qs=

Mortgage Rates: Past, Present, and Possible Future

If you’re hoping to buy a home this year, you’re probably paying close attention to mortgage rates. Since mortgage rates impact what you can afford when you take out a home loan – and affordability is a challenge today – it’s a good time to look at the big picture of where mortgage rates have been historically compared to where they are now. Beyond that, it’s important to understand their relationship with inflation for insights into where mortgage rates might go in the near future.

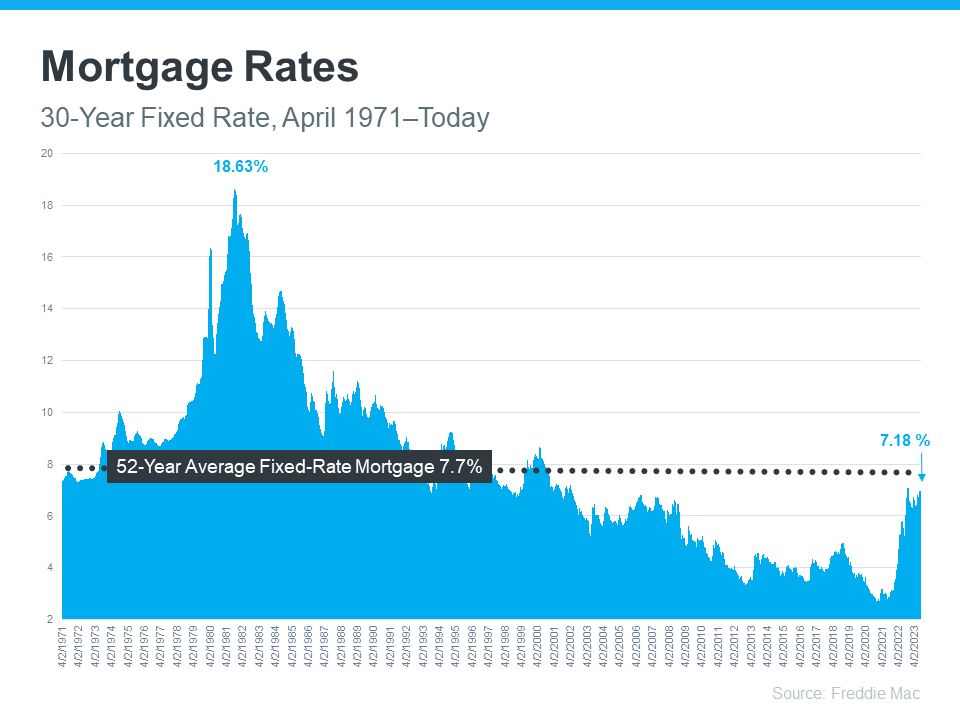

Giving Context to the Sticker Shock

Freddie Mac has been tracking the 30-year fixed mortgage rate since April of 1971. Every week, they release the results of their Primary Mortgage Market Survey, which averages mortgage application data from lenders across the country (see graph below):

Looking at the right side of the graph, mortgage rates have increased significantly since the start of last year. But even with that rise, today’s rates are still below the 52-year average. While that historical perspective is good context, buyers have gotten used to mortgage rates between 3% and 5%, which is where they’ve been over the past 15 years.

Looking at the right side of the graph, mortgage rates have increased significantly since the start of last year. But even with that rise, today’s rates are still below the 52-year average. While that historical perspective is good context, buyers have gotten used to mortgage rates between 3% and 5%, which is where they’ve been over the past 15 years.

That’s important because it explains why the recent jump in rates might have you feeling sticker shock even though they’re close to their long-term average. While many buyers have adjusted to the elevated rates over the past year, a slightly lower rate would be a welcome sight. To determine if that’s a realistic possibility, it’s important to look at inflation.

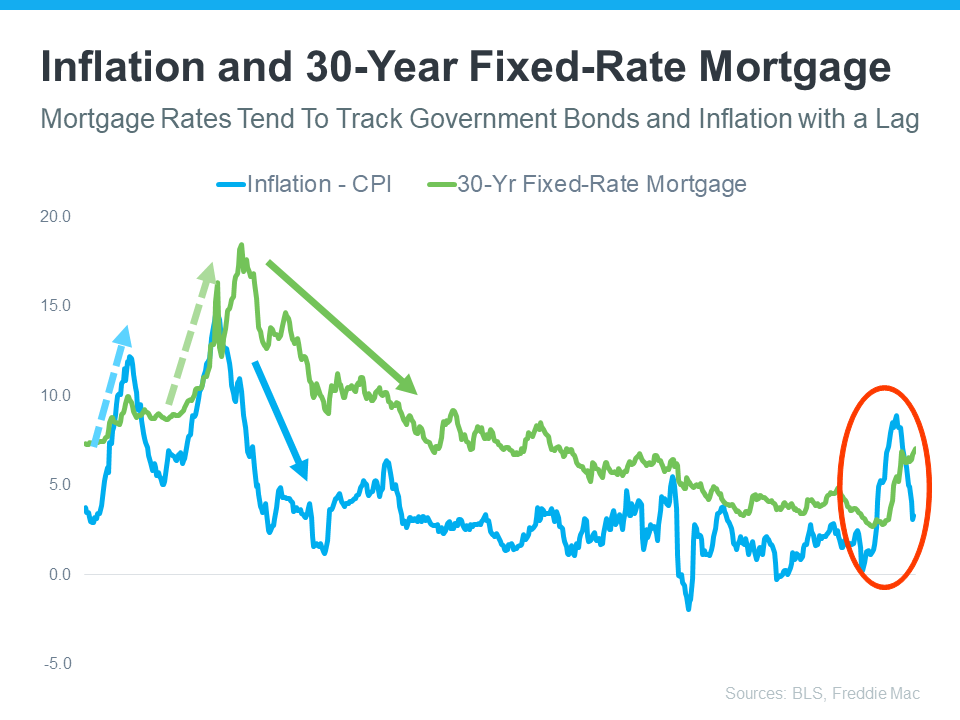

Where Could Mortgage Rates Go in the Future?

The Federal Reserve has been working hard to lower inflation since early 2022. That’s significant because, historically, there’s been a connection between inflation and mortgage rates (see graph below):

This graph shows a pretty reliable relationship between inflation and mortgage rates. Looking at the left side of the graph, each time inflation moves significantly (shown in blue), mortgage rates follow suit shortly after (shown in green).

This graph shows a pretty reliable relationship between inflation and mortgage rates. Looking at the left side of the graph, each time inflation moves significantly (shown in blue), mortgage rates follow suit shortly after (shown in green).

The circled portion of the graph points out the most recent spike in inflation, with mortgage rates following closely behind. As inflation has moderated a bit this year, mortgage rates haven’t yet made a similar move.

That means, if history is any guide, the market is waiting for mortgage rates to follow inflation and head back down. It’s impossible to accurately predict where mortgage rates will go for sure, but moderating inflation means mortgage rates going down in the near future would fit a well-established trend.

Bottom Line

To understand where mortgage rates may be going, it’s helpful to look at where they’ve been in the past. There’s a clear connection between inflation and mortgage rates, and if that historical relationship holds true, the recent decline in inflation may mean good news for the future of mortgage rates and your homeownership goals.

Expert Home Price Forecasts Revised Up for 2023

Toward the end of last year, there were a number of headlines saying home prices were going to fall substantially in 2023. That led to a lot of fear and questions about whether there was going to be a repeat of the housing crash that happened back in 2008. But the headlines got it wrong.

While there was a slight home price correction after the sky-high price appreciation during the ‘unicorn’ years, nationally, home prices didn’t come crashing down. If anything, prices were a lot more resilient than many people expected.

Let’s take a look at some of the expert forecasts from late last year stacked against their most recent forecasts to show that even the experts recognize they were overly pessimistic.

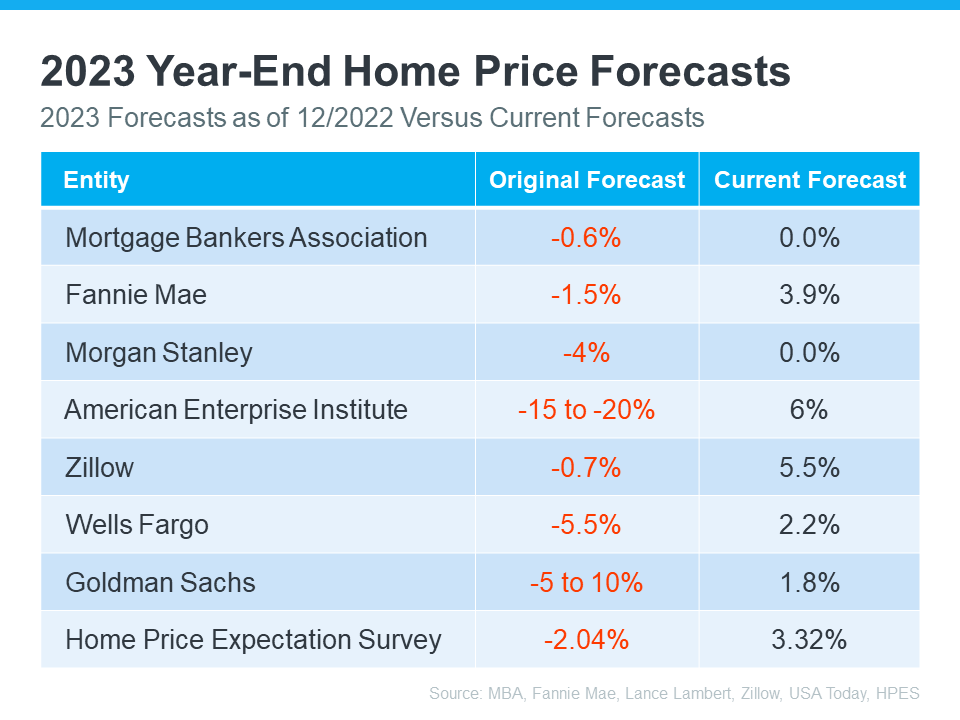

Expert Home Price Forecasts: Then and Now

This visual shows the 2023 home price forecasts from seven organizations. It provides the original 2023 forecasts (released in late 2022) for what would happen to home prices by the end of this year and their most recently revised 2023 forecasts (see chart below):

As the red in the middle column shows, in all instances, their original forecast called for home prices to fall. But, if you look at the right column, you’ll see all experts have updated their projections for the year-end to show they expect prices to either be flat or have positive growth. That’s a significant change from the original negative numbers.

There are a number of reasons why home prices are so resilient to falling. As Odeta Kushi, Deputy Chief Economist at First American, says:

“One thing is for sure, having long-term, fixed-rate debt in the U.S. protects homeowners from payment shock, acts as an inflation hedge – your primary household expense doesn’t change when inflation rises – and is a reason why home prices in the U.S. are downside sticky.”

A Look Forward To Get Ahead of the Next Headlines

For home prices, you’re going to continue to see misleading media coverage in the months ahead. That’s because there’s seasonality to home price appreciation and they’re going to misunderstand that. Here’s what you need to know to get ahead of the next round of negative headlines.

As activity in the housing market slows at the end of this year (as it typically does each year), home price growth will slow too. But, this doesn’t mean prices are falling – it’s just that they’re not increasing as quickly as they were when the market was in the peak homebuying season.

Basically, deceleration of appreciation is not the same thing as home prices depreciating.

Bottom Line

The headlines have an impact, even if they’re not true. While the media said home prices would fall significantly in their coverage at the end of last year, that didn’t happen. Let’s connect so you have a trusted resource to help you separate fact from fiction with reliable data.

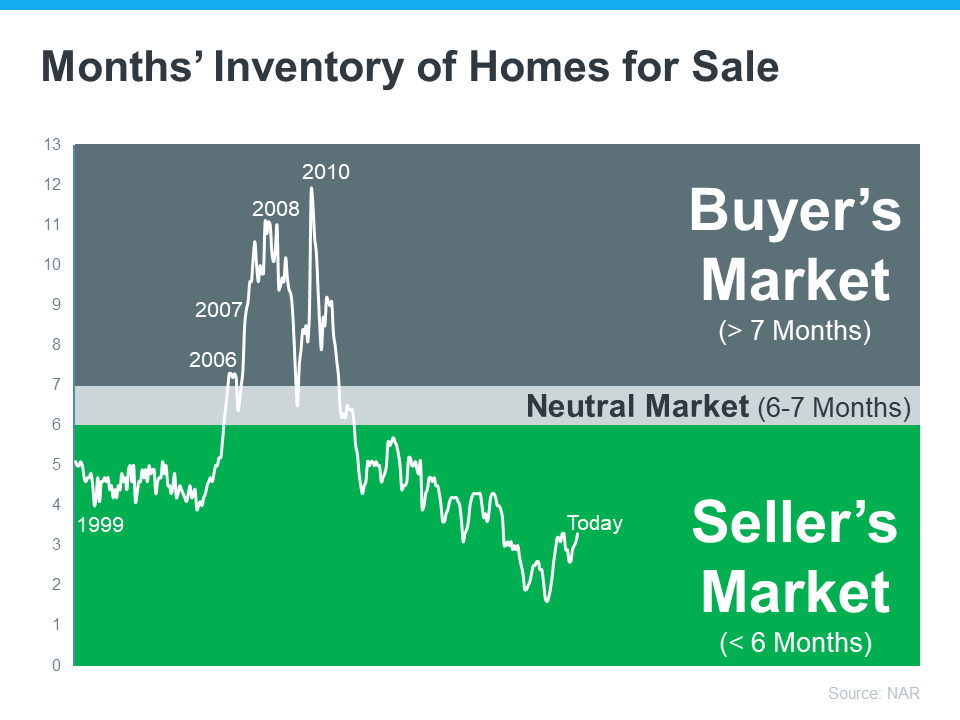

Why It’s Still a Seller’s Market Today

Even though activity in the housing market has slowed from the frenzy that was the ‘unicorn’ years, it’s still a seller’s market because the supply of homes for sale is so low. But what does that really mean for you? And why are conditions today so good if you want to sell your house?

The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Housing inventory is measured by the number of available homes on the market. It’s also measured by months’ supply, meaning the number of months it would take to sell all those available homes based on current demand. In a balanced market, there’s usually about a six-month supply. Today, we have only about 3 months’ supply of homes at the current sales pace (see graph below):

As the visual shows, given the current inventory of homes, it’s still a seller’s market.

As the visual shows, given the current inventory of homes, it’s still a seller’s market.

Today, we’re nowhere near what’s considered a balanced market. In fact, the current months’ supply is half of what’s typical of a normal market. That means there just aren’t enough homes to go around based on today’s buyer demand.

As Lawrence Yun, Chief Economist for NAR, says:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

How Does Being in a Seller’s Market Benefit You?

Sellers, these conditions give you a real edge. Right now, there are buyers who are ready, willing, and able to purchase a home. And, because there’s a shortage of homes up for sale, the ones that do hit the market are like magnets for those buyers.

If you work with a local real estate agent to list your house right now, in good condition, and at the right price, it could get a lot of attention. You might even end up with multiple offers.

Bottom Line

Today’s seller’s market sets you up with a big advantage when you sell your house. Because supply is so low, your house will be in the spotlight for motivated buyers who are craving more options.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link