Foreclosures and Bankruptcies Won’t Crash the Housing Market

If you’ve been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could make you feel uneasy, especially if you’re thinking about buying or selling a house.

But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis.

Foreclosure Activity Rising, but Less Than Headlines Suggest

In recent years, the number of foreclosures has been very low. That’s because, in 2020 and 2021, the forbearance program and other relief options were put in place to help many homeowners stay in their homes during that tough time.

When the moratorium ended, there was an expected rise in foreclosures. But just because they’re up, that doesn’t mean the housing market is in trouble.

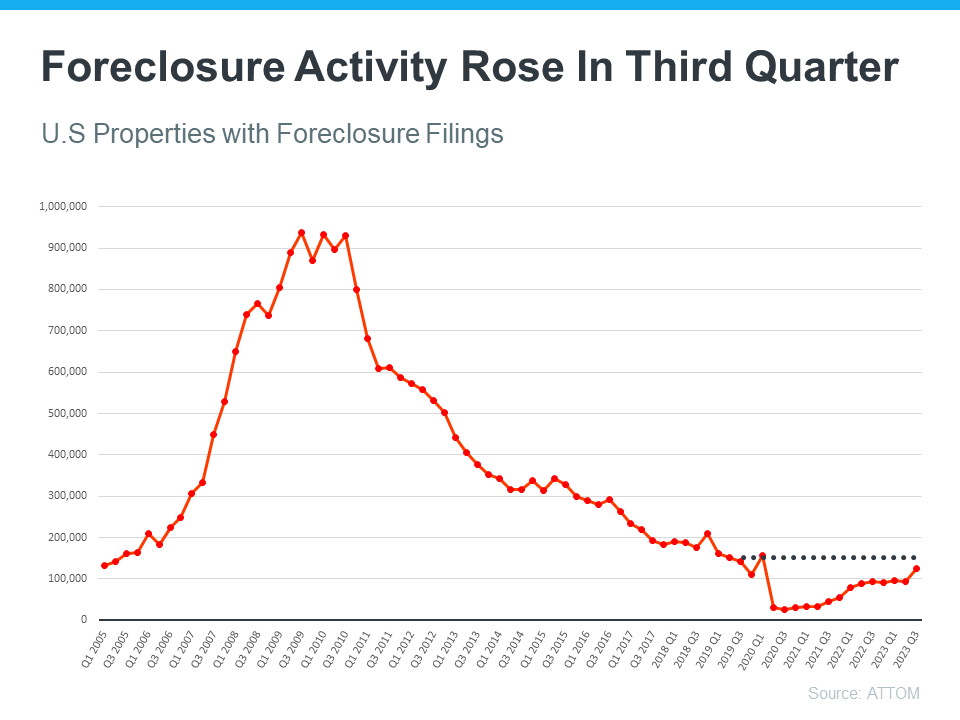

To help you see how much things have changed since the housing crash in 2008, check out the graph below using research from ATTOM, a property data provider. It looks at properties with a foreclosure filing going all the way back to 2005 to show that there have been fewer foreclosures since the crash.

As you can see, foreclosure filings are inching back up to pre-pandemic numbers, but they’re still way lower than when the housing market crashed in 2008. Today, the tremendous amount of equity American homeowners have in their homes can help people sell and avoid foreclosure.

The Increase in Bankruptcies Isn’t Dramatic Either

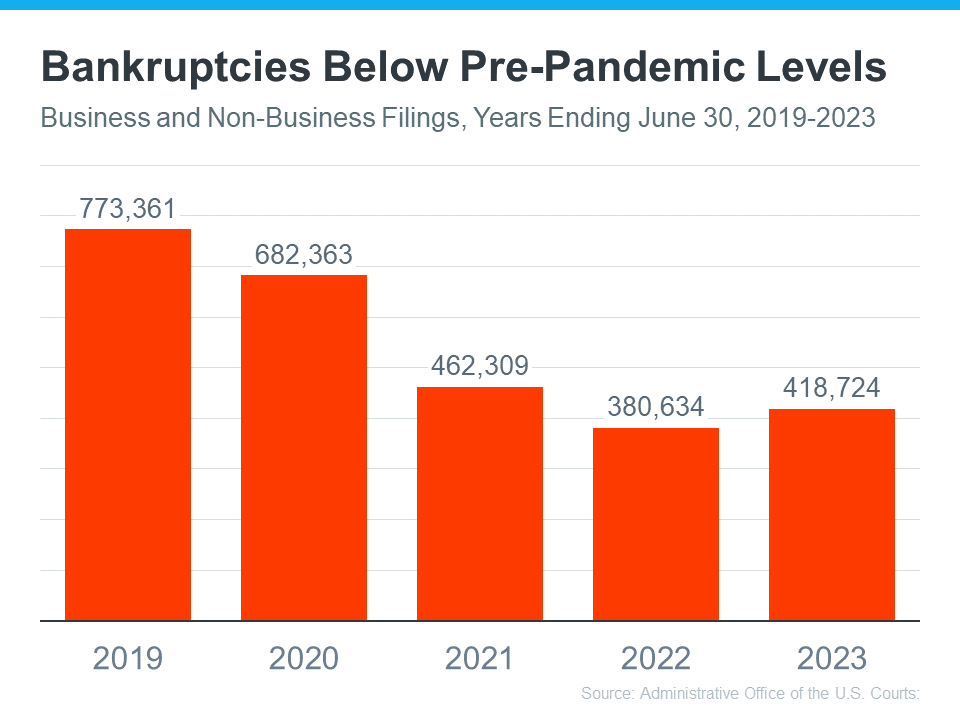

As you can see below, the financial trouble many industries and small businesses felt during the pandemic didn’t cause a dramatic increase in bankruptcies. Still, the number of bankruptcies has gone up slightly since last year, nearly returning to 2021 levels. But that isn’t cause for alarm.

The numbers for 2021 and 2022 were lower than more typical years. That’s in part because the government provided trillions of dollars in aid to individuals and businesses during the pandemic. So, let’s instead focus on the bar for this year and compare it to the bar on the far left (2019). It shows the number of bankruptcies today is still nowhere near where it was before the pandemic. Both of these two factors are reasons why the housing market isn’t in danger of crashing.

Bottom Line

Right now, it’s crucial to understand the data. Foreclosures and bankruptcies are rising, but these leading indicators aren’t signaling trouble that would cause another crash.

The Perks of Selling Your House When Inventory Is Low

When it comes to selling your house, you’re probably trying to juggle the current market conditions and your own needs as you plan your move.

One thing that may be working in your favor is how few homes there are for sale right now. Here’s what you need to know about the current inventory situation and what it means for you.

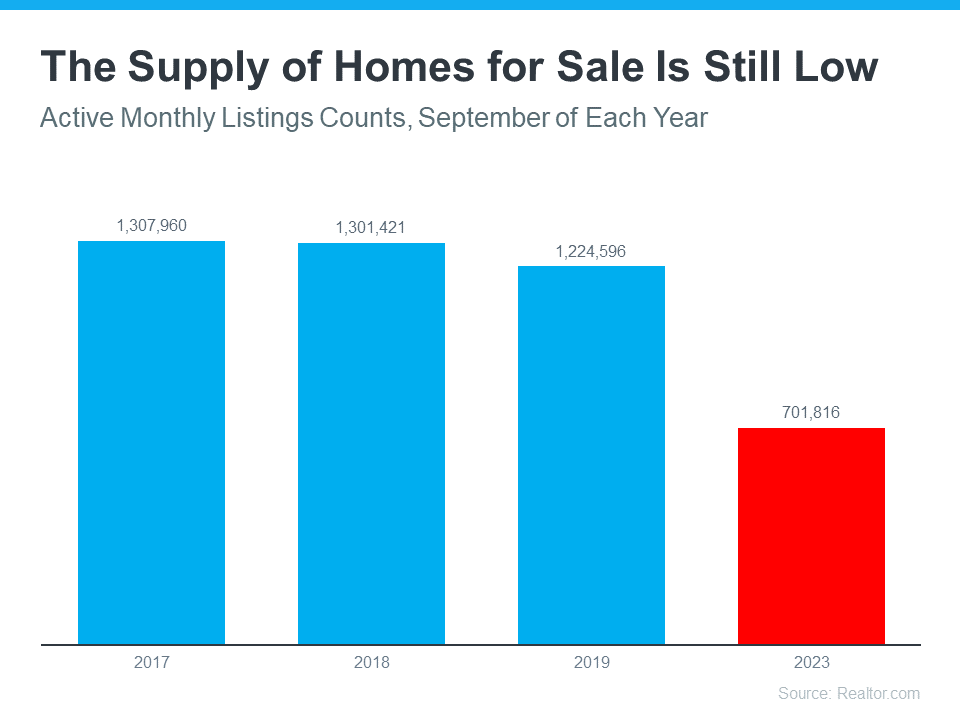

The Supply of Homes for Sale Is Far Below the Norm

When you’re selling something, it helps if what you’re selling is in demand, but is also in low supply. Why? That makes it even more desirable since there’s not enough to go around. That’s exactly what’s happening in the housing market today. There are more buyers looking to buy than there are homes for sale.

To tell the story of just how low inventory is, here’s the latest information on active listings, or homes available for sale. The graph below uses data from Realtor.com to show how many active listings there were in September of this year compared to what’s more typical in the market.

As you can see in the graph, if you look at the last normal years for the market (shown in the blue bars) versus the latest numbers for this year (shown in the red bar), it’s clear inventory is still far lower than the norm.

What That Means for You

Buyers have fewer choices now than they did in more typical years. And that’s why you could still see some great perks if you sell today. Because there aren’t enough homes to go around, homes that are priced right are still selling fast and the average seller is getting multiple offers from eager buyers. Based on the latest data from the Confidence Index from the National Association of Realtors (NAR):

- 69% of homes sold in less than a month.

- 2.6 offers: the average number of offers on recently sold homes.

An article from Realtor.com also explains how the limited number of houses for sale benefits you if you’re selling:

“. . . homes spent two weeks less on the market this past month than they did in the average September from 2017 to 2019 . . . as still-limited supply spurs homebuyers to act quickly . . .”

Bottom Line

Because the supply of homes for sale is so low, buyers desperately want more options – and your house may be just what they’re looking for. Let’s connect to get your house listed at the right price for today’s market. You could still see it sell quickly and potentially get multiple offers.

Why Home Prices Keep Going Up

If you’ve ever dreamed of buying your own place or selling your current house to upgrade, you’re no stranger to the rollercoaster of emotions that changing home prices can stir up. It’s a tale of financial goals, doubts, and a dash of anxiety that many have been through.

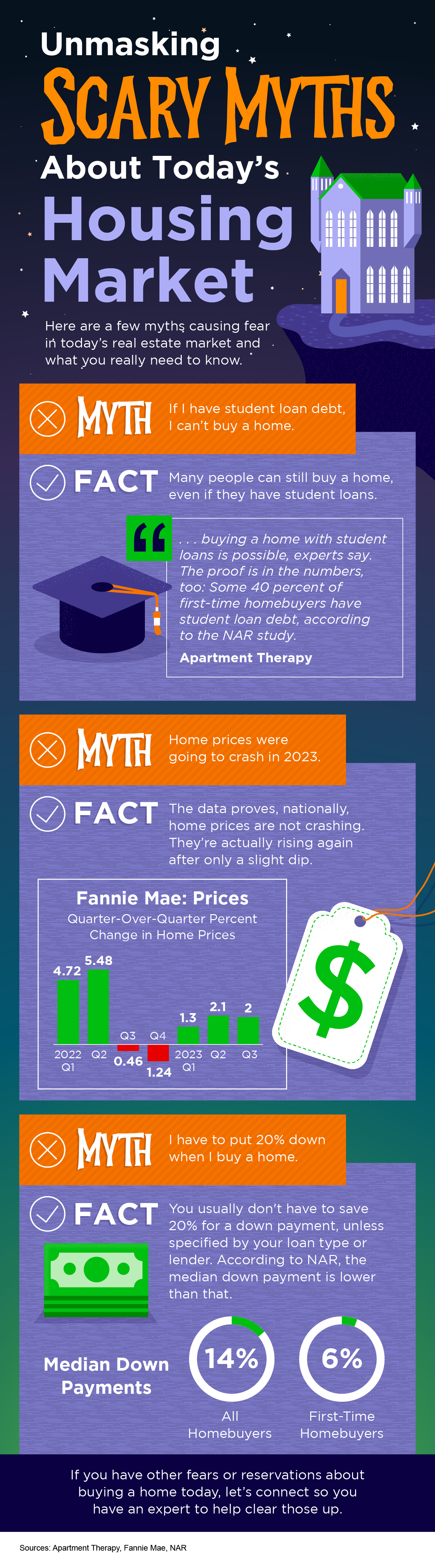

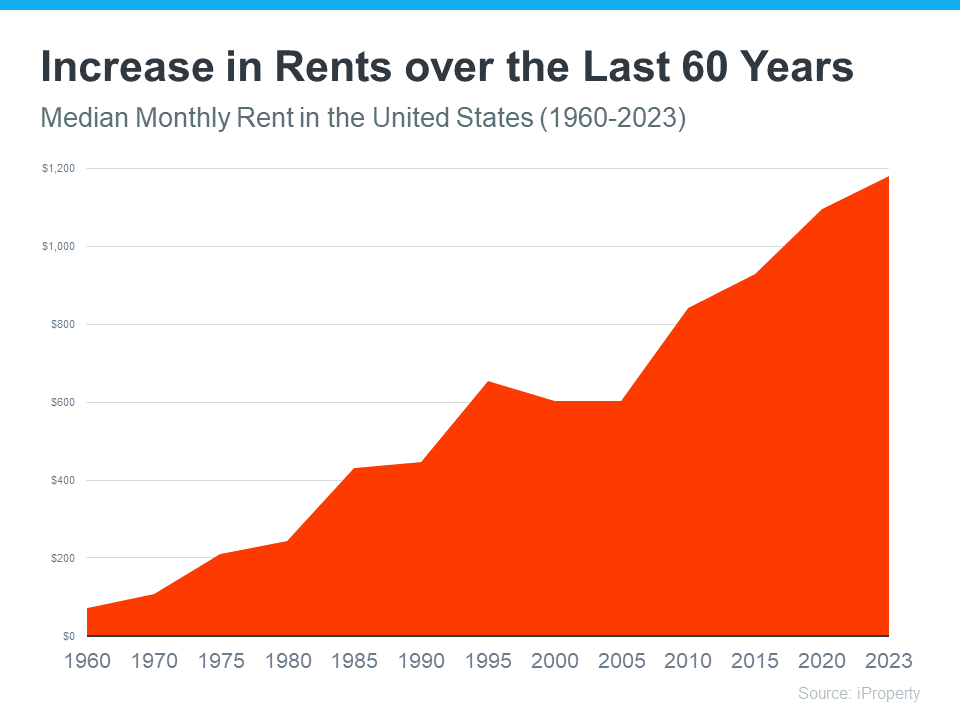

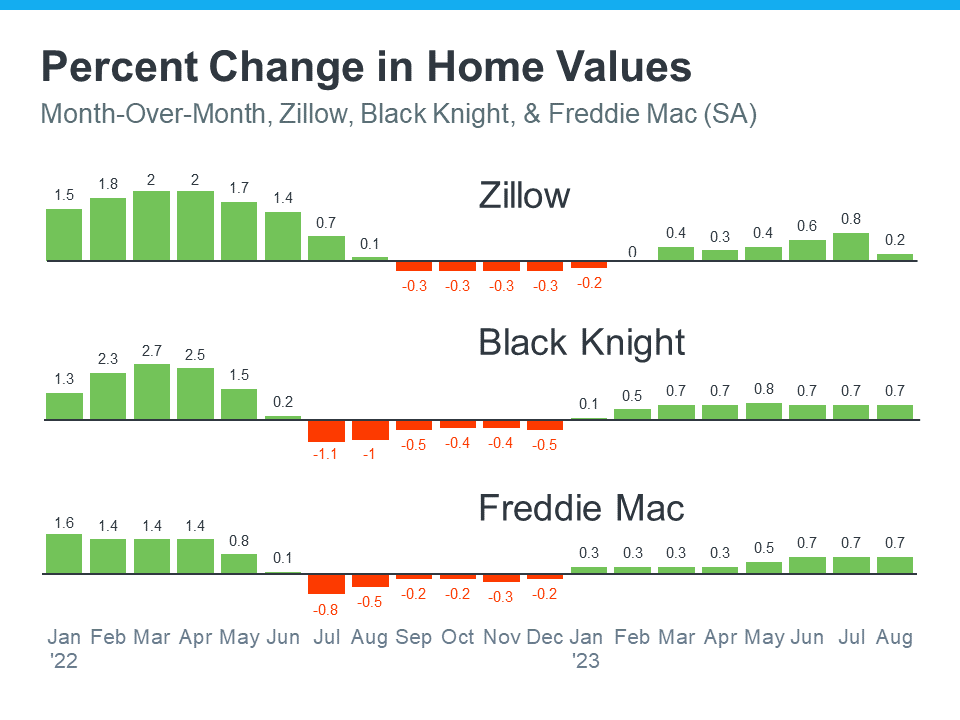

If you put off moving because you’re worried home prices might drop, make no mistake, they’re not going down. In fact, it’s just the opposite. National data from several sources say they’ve been going up consistently this year (see graph below):

Here’s what this graph shows. In the first half of 2022, home prices rose significantly (the green bars on the left side of the graphs above). Those increases were dramatic and unsustainable.

In the second half of the year, prices went through a correction and started dipping a bit (shown in red) but those slight declines were shallow and short-lived. Still, the media focused on those drops in their headlines and that created a lot of fear and uncertainty among consumers.

Here’s what hasn’t been covered fully. So far in 2023, prices have been going up but this time at a more normal pace (the green bars on the right side of the graphs above). After price gains that were too high and then the corrections that followed in 2022, the fact that all three reports show more normal or typical price appreciation this year is good news for the housing market.

Orphe Divounguy, Senior Economist at Zillow, explains changing home prices over the past 12 months this way:

“The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023. . . . That downturn has proven to be short lived as housing has rebounded impressively so far in 2023. . .”

Looking ahead, home price appreciation typically starts to ease up this time of year. As that happens, there’s some risk the media will confuse slowing price growth (deceleration of appreciation) with home prices falling (depreciation). Don’t be fooled. Slower price growth is still growth.

Why Are Home Prices Increasing Now?

One reason why home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.

Even though higher mortgage rates cause buyer demand to moderate, they also cause the supply of available homes to go down. That’s because of the mortgage rate lock-in effect. When rates rise, some homeowners are reluctant to sell and lose their current low mortgage rate just to take on a higher one for their next home.

So, with higher mortgage rates impacting both buyers and sellers, the supply and demand equation of the housing market has been affected. But since there are still more people who want to purchase homes than there are homes available to buy, prices continue to rise. As Freddie Mac states:

“While rising interest rates have reduced affordability—and therefore demand—they have also reduced supply through the mortgage rate lock-in effect. Overall, it appears the reduction in supply has outweighed the decrease in demand, thus house prices have started to increase . . .”

Here’s How This Impacts You

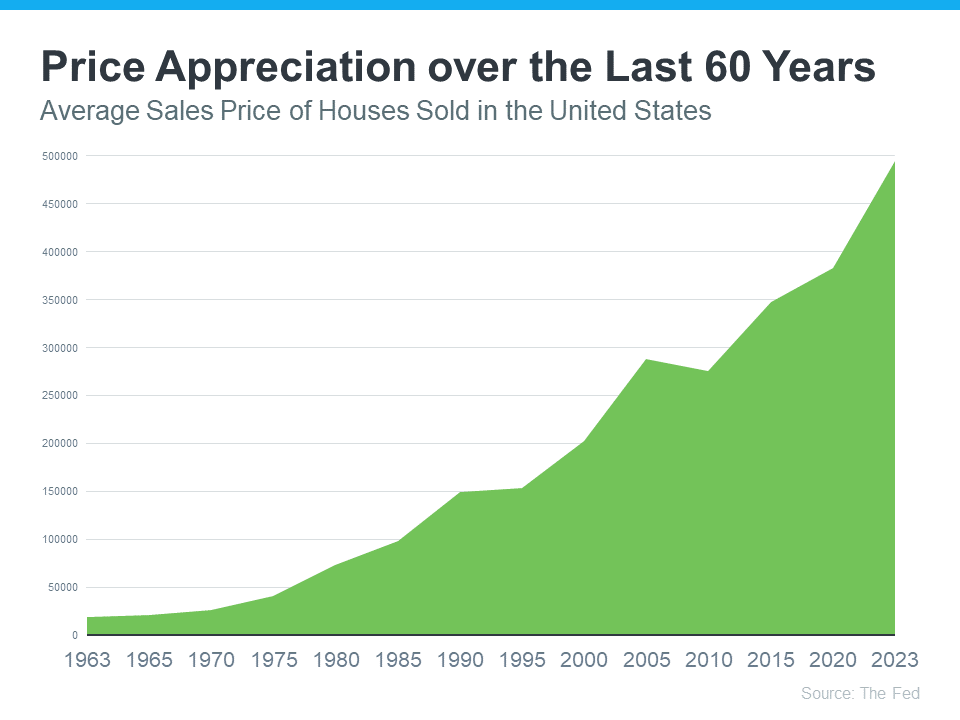

- Buyers: If you’ve been waiting to buy a home because you were afraid its value might drop, knowing that home prices have gone back up should make you feel better. Buying a home gives you a chance to own something that usually becomes more valuable over time.

- Sellers: If you’ve been holding off on selling your house because you were worried about how changing home prices would impact its value, it could be a smart move to work with a real estate agent and put your house on the market. You don’t have to wait any longer because the most recent data indicates home prices have turned in your favor.

Bottom Line

If you put off moving because you were worried that home prices might go down, data shows they’re increasing across the country.

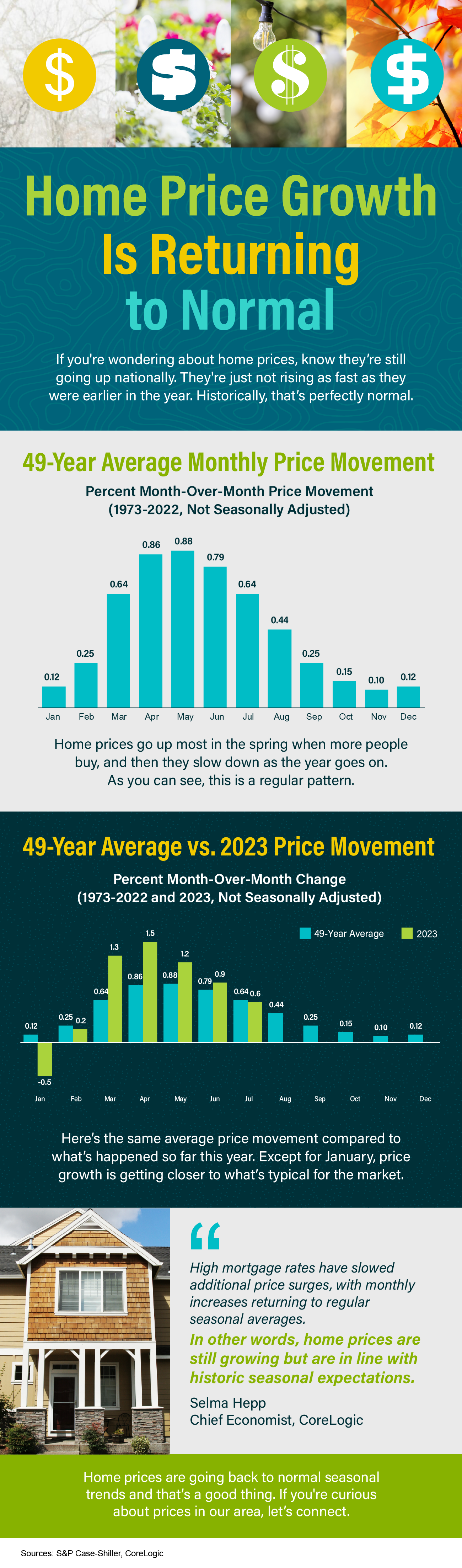

Home Price Growth Is Returning to Normal [INFOGRAPHIC]

Some Highlights

- If you’re wondering what’s happening with home prices, know they’re still rising, just at a slower pace – and that’s perfectly normal for this time of year.

- Based on typical seasonality in the market, prices go up most in the spring during the peak buying season, and then price growth slows down as the year goes on.

- Home prices aren’t falling. They’re just rising slower and going back to normal seasonal trends. That’s a good thing. If you’re curious about prices in our area, give me a shout!

The Risks of Selling Your House on Your Own

Are you thinking about selling your house as a For Sale by Owner (FSBO)? If so, know there’s a whole lot more time and expertise needed in that process than you might think. While the idea of doing it all by yourself might seem tempting, it’s important to recognize the challenges you may face if you take it on all by yourself. As a recent article from Bankrate explains:

“Choosing the right price, crafting a compelling listing, marketing to potential buyers, coordinating showings, preparing paperwork: All of these are tasks that, in the absence of a real estate agent, you will have to do yourself.”

Here’s a bit more information on just a few of those things and how you may miss out if you don’t use an agent.

You May Not Price it Right

Pricing your house right is key to a successful sale. Real estate agents have experience navigating this housing market and understand the art of pricing a home to sell today. Unfortunately, homeowners who sell on their own often lack this all-important experience, which can lead to two common consequences: overpricing or underpricing the house.

An article from Nerd Wallet offers this advice:

“If your home is overpriced, you run the risk of buyers not seeing the listing. . . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house.”

Don’t run this risk. Instead, partner with an agent to make sure your house is priced at current market value, so it catches the eyes of eager buyers. This will put your house in a position to make the best first impression possible.

You Don’t Have as Much Experience in Marketing a House

In this digital age, online marketing has become a real game-changer, especially when it comes to selling your house. A recent report from the National Association of Realtors (NAR), explains:

“Among all generations of home buyers, the first step taken in the home search process was to look online for properties.”

When you partner with a real estate agent who knows how to take advantage of online marketing tools and resources, you’ll be able to get in front of these tech-savvy house hunters, boosting your chances of a successful sale. However, if you’re attempting to sell your house on your own, you might find yourself missing out on the full power of online and social media strategies.

You May Not Be Comfortable Handling All the Back-and-Forth

When you decide to sell your house, you’re not just on a quest to find a buyer; you’re also stepping into a world of negotiations. You’ll have to coordinate with a bunch of people, including the buyer, the buyer’s agent, the home inspector, the appraiser, and more. It’s a dance where every move counts and the expertise of a real estate agent can make a world of difference in keeping these negotiations on track and sealing the deal.

As NerdWallet says:

“Your listing agent will also, of course, be on your side throughout negotiations. They’ll double-check paperwork that comes through, communicate with the buyer’s agent and other parties to the sale, and generally stay on top of things through to closing day.”

Bottom Line

If you’re thinking about selling your house and the idea of going it alone has crossed your mind, be sure to think through that decision carefully.

What Are the Real Reasons You Want To Move Right Now?

If you’re considering selling your house right now, it’s likely because something in your life has changed. While things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place.

It’s true mortgage rates are higher right now, and that has an impact on affordability. As a result, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home.

But your lifestyle and your changing needs matter, too. As a recent article from Realtor.com says:

“No matter what interest rates and home prices do next, sometimes homeowners just have to move—due to a new job, new baby, divorce, death, or some other major life change.”

Here are a few of the most common reasons people choose to sell today. You may find any one of these resonates with you and may be reason enough to move, even today.

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in your ideal location, or simply looking for a change in scenery.

For example, if you just landed your dream job in another state, you may be thinking about selling your current home and moving for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and your household is growing, it may be time to find a home that better fits those needs.

Downsizing

Homeowners may also decide to sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move somewhere warmer with less house to maintain. A different home may be better suited for your new lifestyle.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and getting a place of your own may be a better option.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their house to find one that works better for them.

For example, you may be looking to sell your house and use the proceeds to help pay for a unit in an assisted living facility.

With higher mortgage rates and rising prices, there are some affordability challenges right now – but your needs and your lifestyle also matter. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you want to sell your house and find a new one that better fits your needs, let’s chat. That way, you’ll have someone to guide you through the process and help you find a home that works for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link