How an Energy Efficient Home Can Be a Bright Idea [INFOGRAPHIC]

![How an Energy Efficient Home Can Be a Bright Idea [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/23164218/20220325-MEM-1046x1745.png)

Some Highlights

- With inflation driving up the cost of everyday items, seeking out an energy-efficient home can be a great way to decrease the expenses you can control.

- Energy efficiency can help lower your utility bills and possibly even save you money on your taxes. Options to look for include efficient appliances, windows, and solar panels.

- If you’re planning to buy a home this year, consider energy efficiency in your search.

The Average Homeowner Gained More Than $55K in Equity over the Past Year

If you’re a current homeowner, you should know your net worth just got a big boost. It comes in the form of rising home equity. Equity is the current value of your home minus what you owe on the loan. Today, you’re building that equity far faster than you may expect – and this gain is great news for you.

Here’s how it happened. Home values are on the rise thanks to low housing supply and high buyer demand. Basically, there aren’t enough homes available to meet this high buyer interest, so bidding wars are driving home prices up. When you own a home, the rising prices mean your home is worth more in today’s market. And as home values climb, your equity does too. As Dr. Frank Nothaft, Chief Economist at CoreLogic, explains:

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth.”

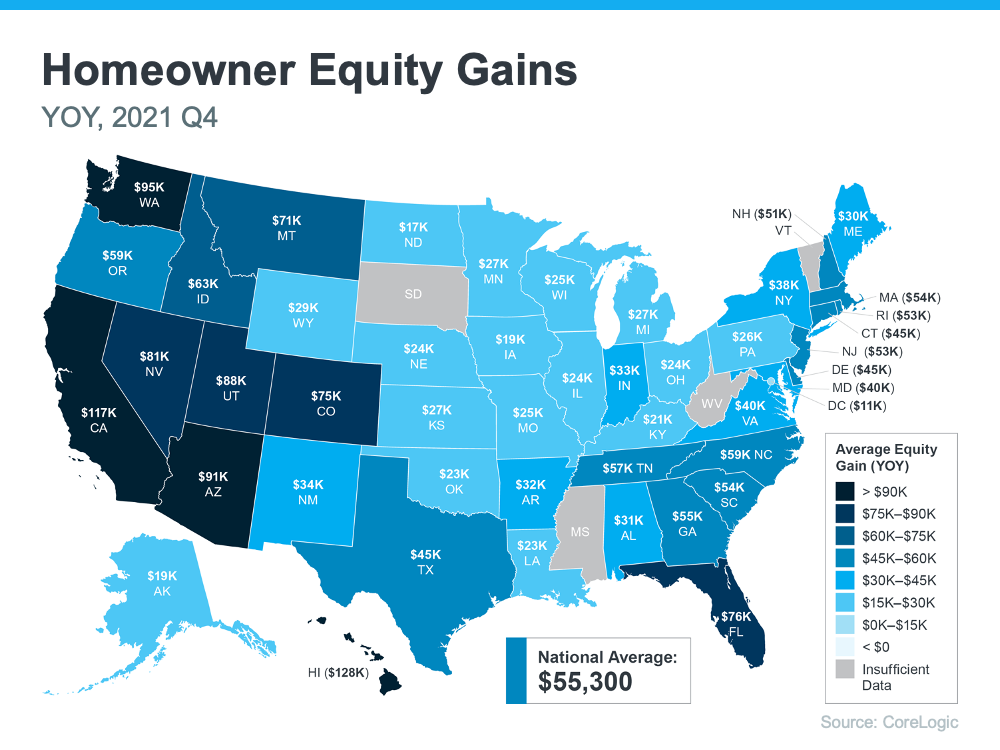

The latest Homeowner Equity Insights from CoreLogic shed light on just how much rising home values have boosted homeowner equity. According to that report, the average homeowner’s equity has grown by $55,300 over the last 12 months.

Want to know what’s happening in your area? Here’s a breakdown of the average year-over-year equity growth for each state based on that data.

How Rising Equity Impacts You

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. It works like this: when you sell your house, the equity you built up comes back to you in the sale.

In a market where you’re gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home. So, if you’ve been holding off on selling and worried about being priced out of your next home because of today’s home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

Equity can be a real game-changer if you’re planning to make investments or make a move. To find out just how much equity you have in your home and how you can use it to fuel your next purchase, give me a shout. I’m happy to provide you with a complimentary professional equity assessment report on your home.

Spring Cleaning Checklist for Sellers [INFOGRAPHIC]

![Spring Cleaning Checklist for Sellers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/16150023/20220318-MEM-1046x1566.png)

Some Highlights

- If you’re thinking about selling your house this spring, here are some things you’ll want to tackle before you list.

- Spend your time on tasks that make it feel inviting, show it’s cared for, and boost your curb appeal.

- To determine the full list of things you’ll want to tackle for your home, you need the opinion of a trusted expert.

Are You Wondering if This Is the Year To Buy a Home?

Every year, many renters ask themselves the same question: Should I continue renting, or is it time to buy a home? If you’re a renter, chances are you’ve asked yourself that question at least once, and it’s likely because you’ve faced an increase in your monthly housing costs over time. After all, according to Census data, rents have risen consistently for decades.

To make an informed and powerful decision, the first step is understanding what’s happening in today’s housing market so you can determine which option is the better long-term financial decision for you.

Rents Are Going Up Again This Year

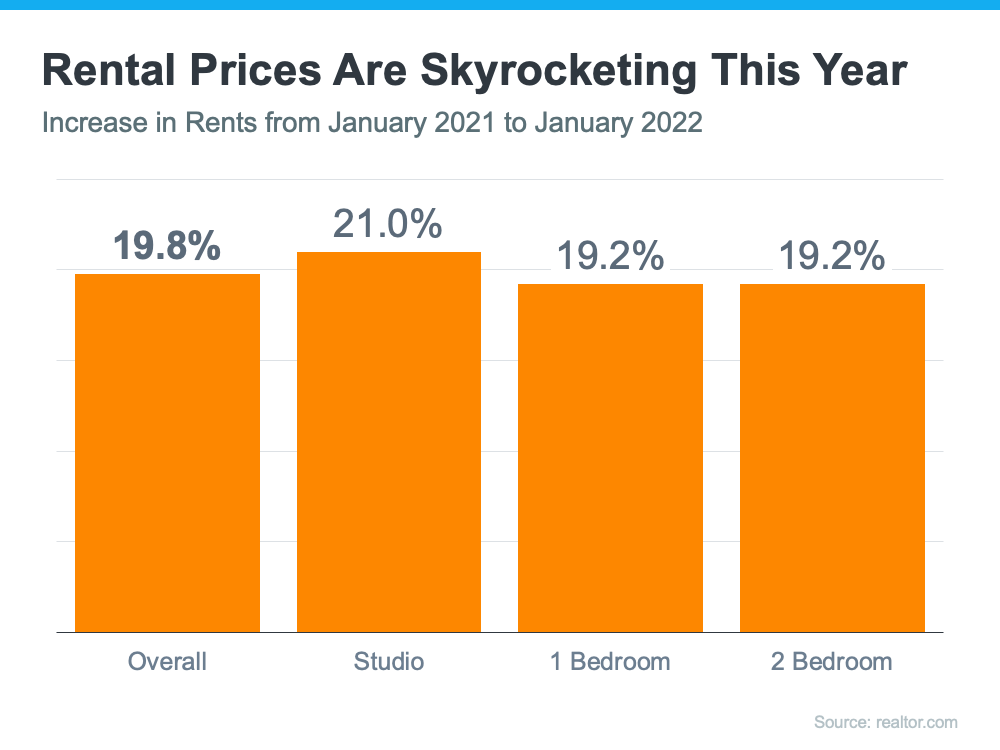

Rents are skyrocketing right now. Data from realtor.com shows just how much rental prices are surging throughout the country. The graph below highlights rental unit price increases over the past year:

If you’re a renter and plan on signing a new lease, your monthly costs are likely to go up when you do. Those rising costs can have a big impact on your financial goals, including any plans you’re making to save for a home purchase.

Homeownership Offers Stable Monthly Costs

Of course, one of the key benefits of owning your home is that you’re able to lock in and stabilize your payments for the duration of your loan. That’s not the case when you rent.

While rents are already on the rise, there’s a good chance many people will see their rental costs increase even more this year. As Danielle Hale, Chief Economist at realtor.com, says:

“With rents already at a high and expected to keep going up, rental affordability will increasingly challenge many Americans in 2022. For those thinking about making the transition from renting to buying their first home, rising rents will remain a motivating factor. . . .”

So, if you’re ready to become a homeowner, waiting any longer may not make financial sense. Instead, escape the cycle of rising rents and enjoy the many benefits that come with homeownership today.

Bottom Line

Starting your journey towards homeownership can pay off significantly this year. If you’re financially ready today, let’s connect so we can discuss your options.

This Spring Presents Sellers with a Golden Opportunity

If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next one.

If that’s the case, you should know – you may be able to get the best of both worlds today. Here are four reasons why this spring may be your golden window of opportunity.

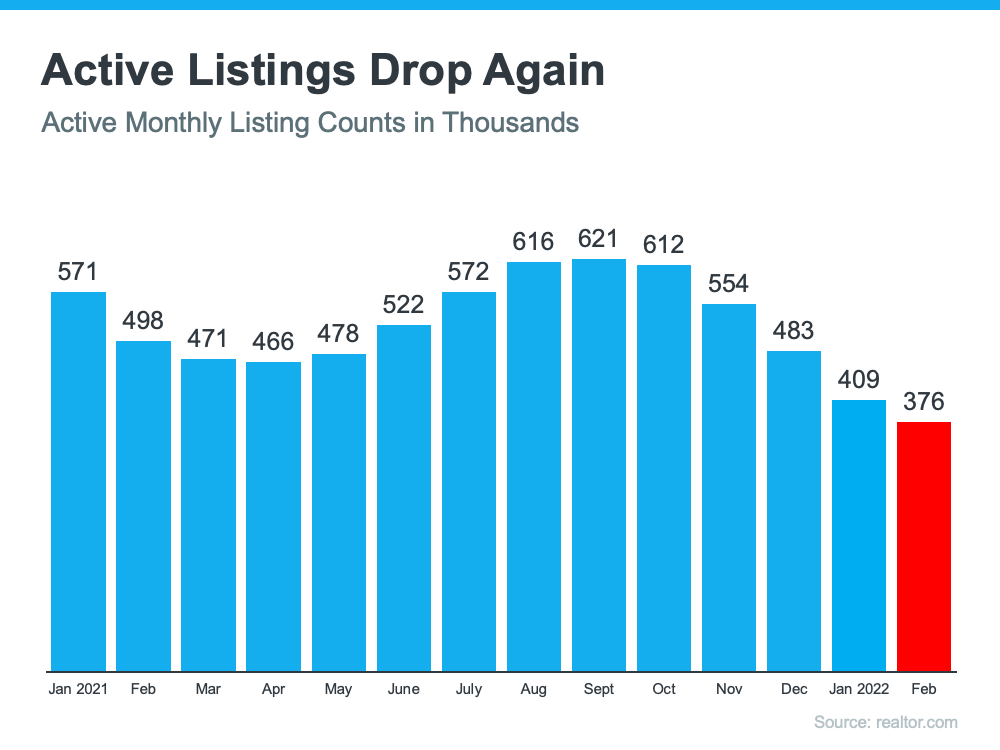

1. The Number of Homes on the Market Is Still Low

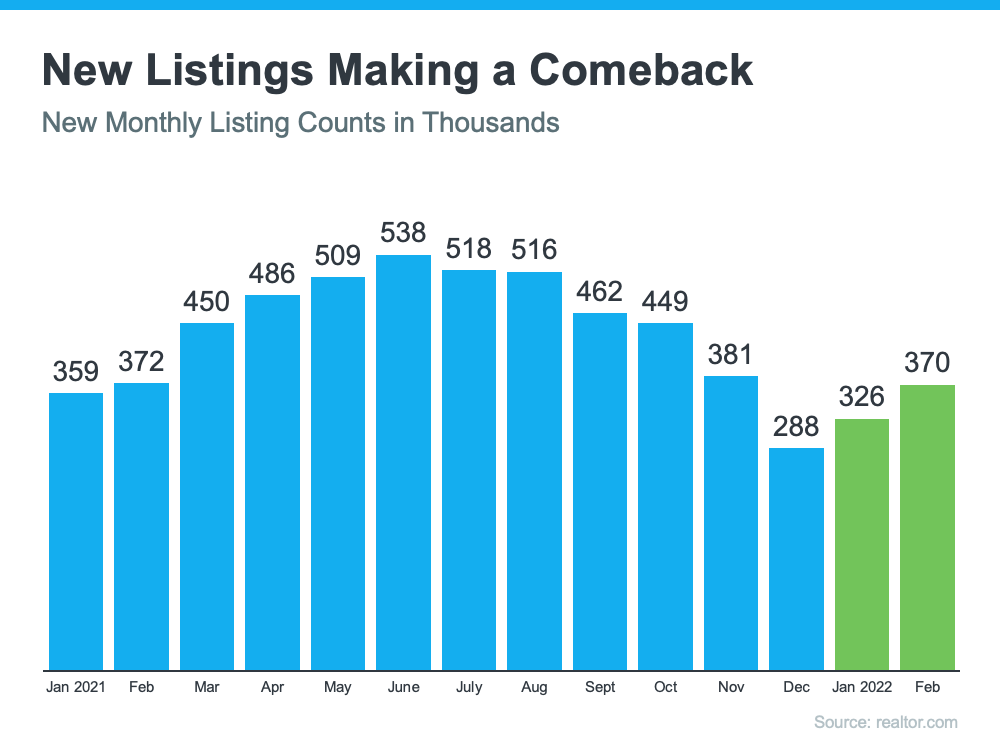

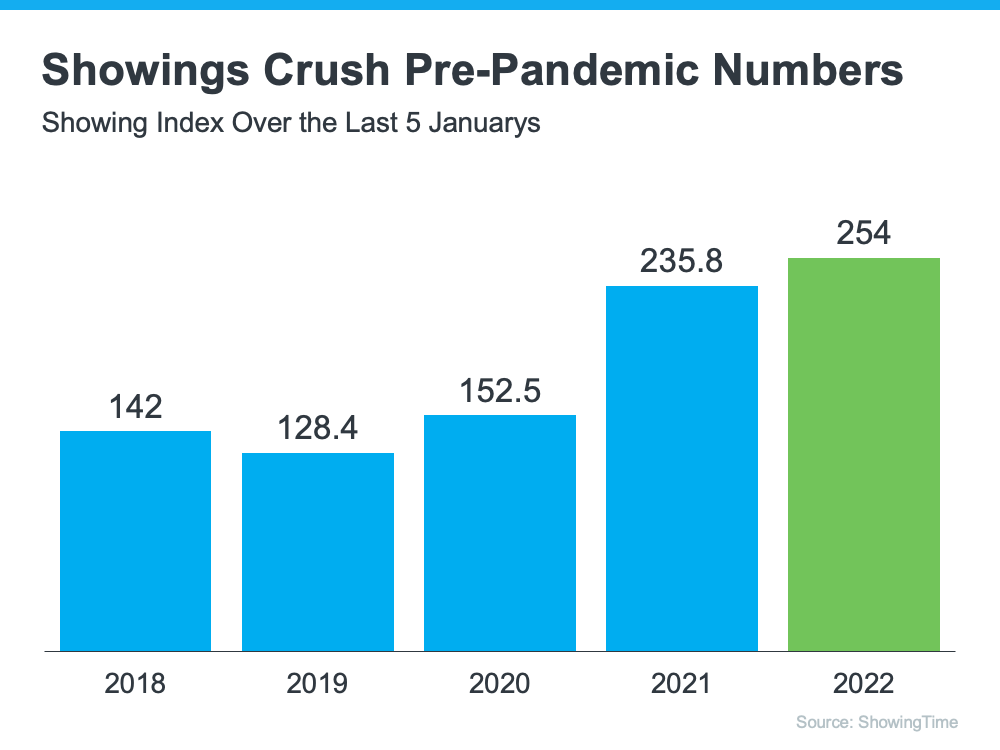

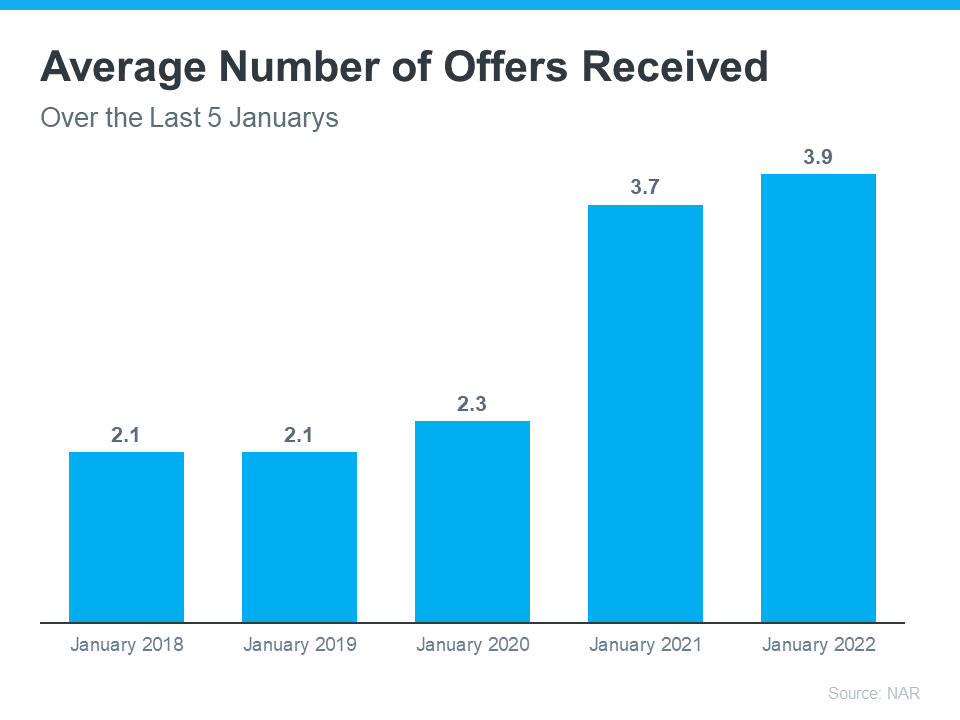

Today’s limited supply of houses for sale is putting sellers in the driver’s seat. There are far more buyers in the market today than there are homes available. That means purchasers are eagerly waiting for your house.

Listing your house now makes it the center of attention. And if you work with a real estate professional to price your house correctly, you can expect it to sell quickly and likely get multiple strong offers this season.

2. Your Equity Is Growing in Record Amounts

According to the most recent Homeowner Equity Insight report from CoreLogic, homeowners are sitting on record amounts of equity thanks to recent home price appreciation. The report finds that the average homeowner has gained $55,300 in equity over the past year.

That much equity can open doors for you to make a move. If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help fuel your move. It may be just what you need to cover a large portion – if not all – of the down payment on your next home.

3. Mortgage Rates Are Increasing

While it’s true mortgage rates have already been climbing this year, current mortgage rates are still below what they’ve been in recent decades. In the 2000s, the average mortgage rate was 6.27%. In the 1990s, the average rate was 8.12%.

For context, the current average 30-year fixed mortgage rate, according to Freddie Mac, is 3.85%. And while recent global uncertainty caused rates to dip slightly in the near-term, experts project rates will rise in the months ahead. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“For homebuyers, we believe that borrowing costs will likely rise with the increase in mortgage rates….”

When that happens, it’ll cost you more to purchase your next home. That’s why it’s important to act now if you’re ready to sell. Work with a trusted advisor to kickstart the process so you can take key steps to make your next purchase before rates climb further.

4. Home Prices Are Climbing Too

Home prices have been skyrocketing in recent years because of the imbalance of supply and demand. And as long as that imbalance continues, so will the rise in home values.

What does that mean for you? If you’re selling so you can move into the home of your dreams or downsize into something that better suits your current needs, you have an opportunity to get ahead of the curve by leveraging your growing equity and purchasing your next home before prices climb higher.

And, once you make your purchase, you can find peace of mind in knowing ongoing home price appreciation is growing the value of your new investment.

Bottom Line

If you want to win when you sell and when you buy, this spring could be your golden opportunity.

Key Factors That Impact Affordability Today

You can’t read an article about residential real estate without the author mentioning the affordability challenges that today’s buyers face. There’s no doubt homes are less affordable today than they were over the last two years, but that doesn’t mean homes are now unaffordable.

There are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each of these components.

1. Home Prices

The most recent Home Price Insights report by CoreLogic shows home values have increased by 19.1% from last January to this January. That was one reason affordability declined over the past year.

2. Mortgage Rates

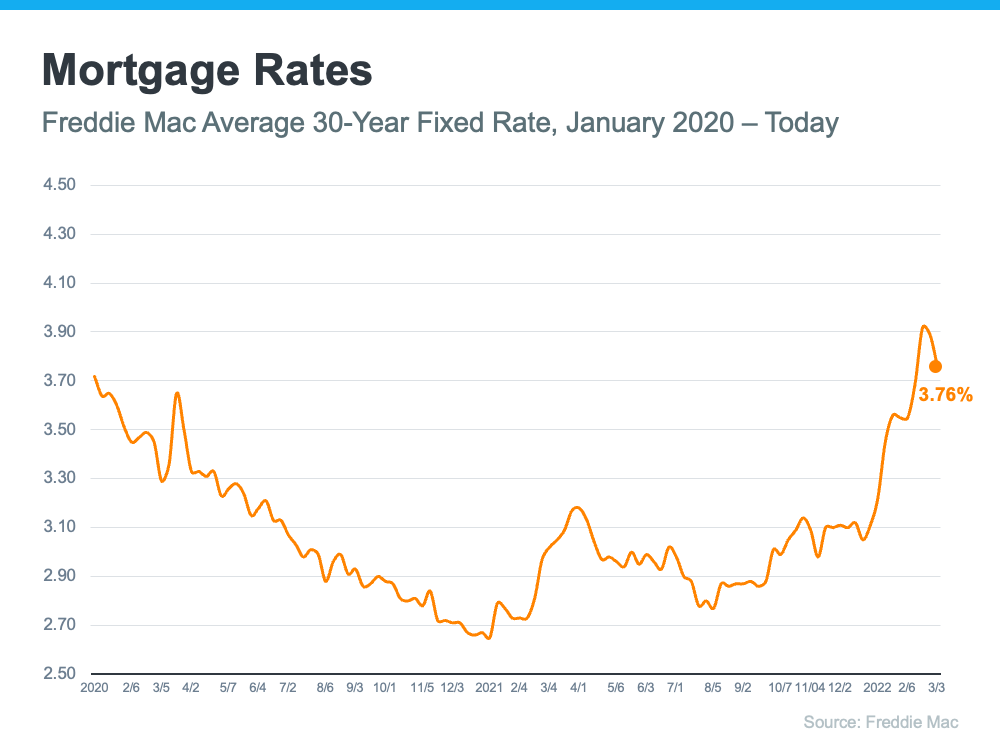

While the current global uncertainty makes it difficult to project mortgage rates, we do know current rates are almost one full percentage point higher than they were last year. According to Freddie Mac, the average monthly rate for last February was 2.81%. This February it was 3.76%. That increase in the mortgage rate also contributes to homes being less affordable than they were last year.

3. Wages

The one big, positive component in the affordability equation is an increase in American wages. In a recent article by RealtyTrac, Peter Miller addresses that point:

“Prices are up, but what about wages? ADP reports that job holder incomes increased 5.9% last year but rose 8.0% for those who switched employers. In effect, some of the higher cost to buy a home has been offset by more cash income.”

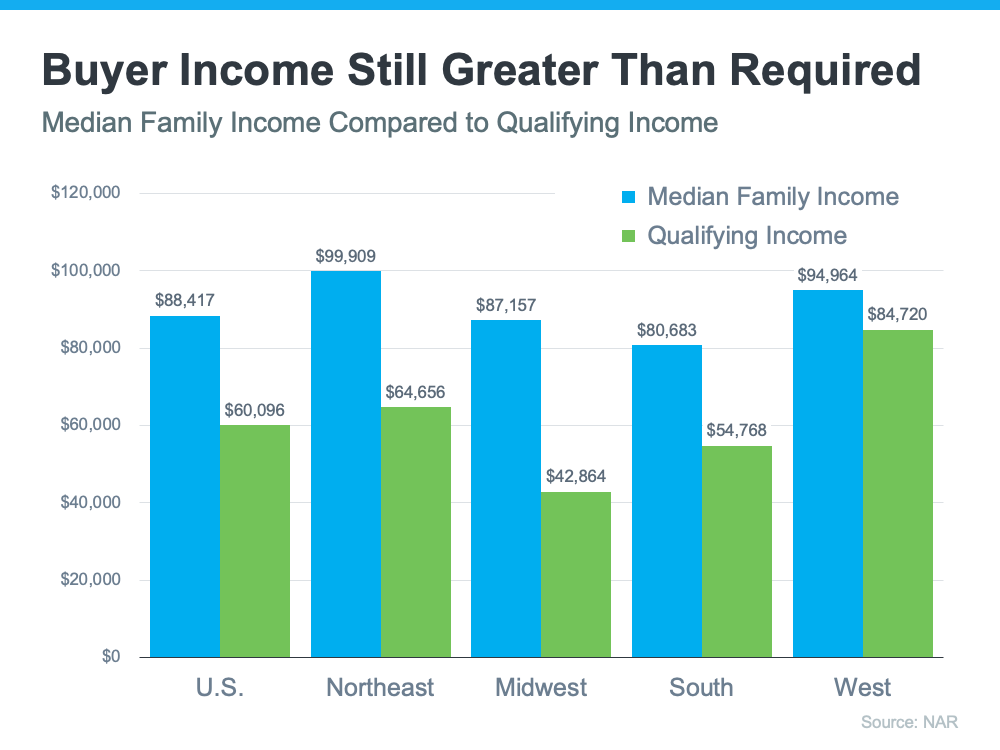

The National Association of Realtors (NAR) also recently released information that looks at income and affordability. The NAR data provides a comparison of the current median family income versus the qualifying income for a median-priced home in each region of the country. Here’s a graph of their findings:

As the graph shows, the median family income (shown in blue on the graph) is greater than the qualifying income needed to buy a median-priced home (shown in green on the graph) in all four regions of the country. While those figures may vary in certain locations within each region, it’s important to note that, in most of the country, homes are still affordable.

So, when you think about affordability, remember that the picture includes more than just home prices and mortgage rates. When prices rise and rates rise, it does impact affordability, and experts project both of those things will climb in the months ahead. That’s why it’s less affordable to buy a home than it was over the past two years when prices and rates were lower than they are today. But wages need to be factored into affordability as well. Because wages have been rising, they’re a big reason that, while less affordable, homes are not unaffordable today.

Bottom Line

To find out more about affordability in our local area, let’s discuss where home prices are locally, what’s happening with mortgage rates, and get you in contact with a lender so you can make an informed financial decision. Remember, while less affordable, homes are not unaffordable, which still gives you an opportunity to buy today.

How Global Uncertainty Is Impacting Mortgage Rates

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.”

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Bottom Line

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link