Owning Is More Affordable than Renting in the Majority of the Country

If you were thinking about buying a home this year, but already pressed pause on your plans due to rising home prices and increasing mortgage rates, there’s something you should consider. According to the latest report from ATTOM Data, owning a home is more affordable than renting in the majority of the country. The 2022 Rental Affordability Report says:

“. . . Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting.”

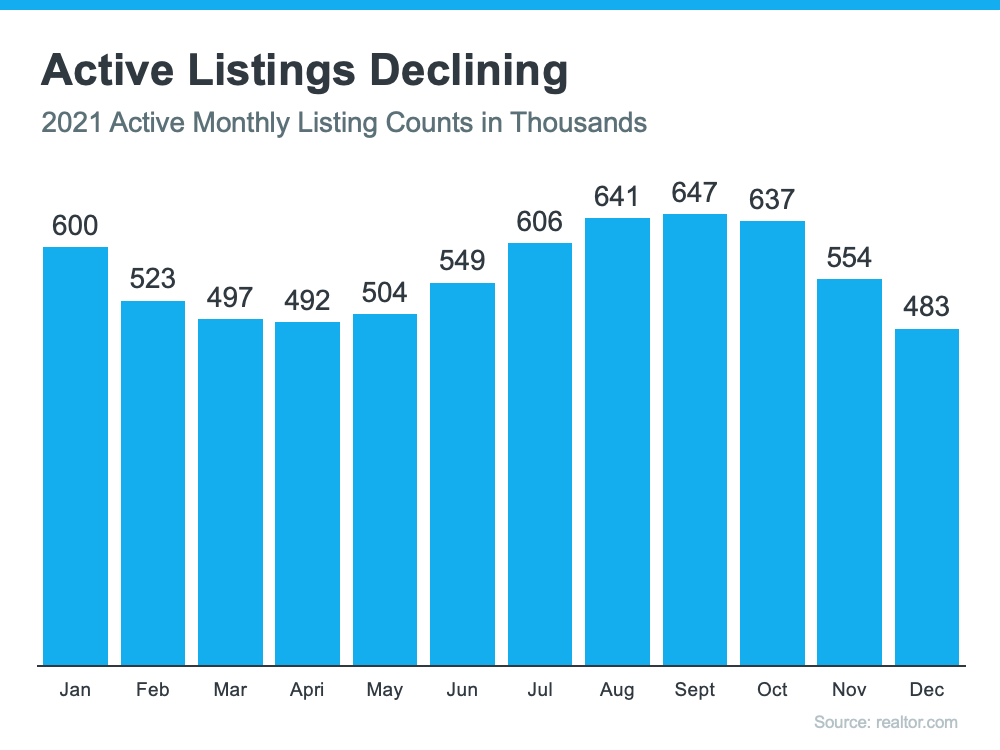

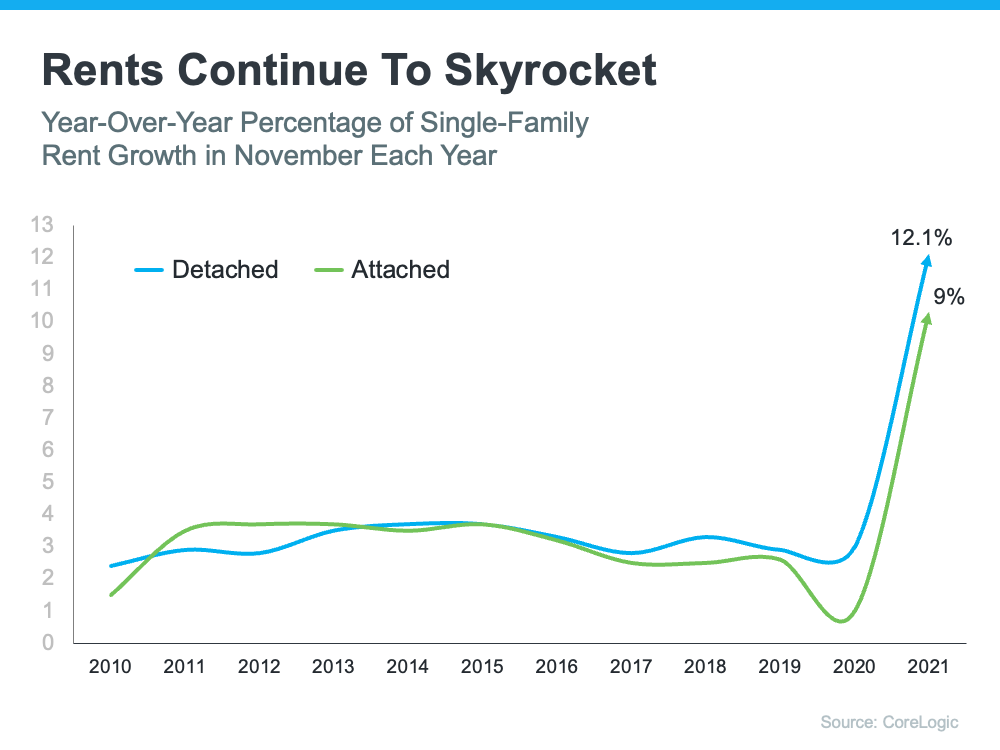

Other experts in the industry offer additional perspectives on renting today. In the latest Single-Family Rent Index from CoreLogic, single-family rent saw the fastest year-over-year growth in over 16 years when comparing data for November each year (see graph below):

Molly Boesel, Principal Economist at CoreLogic, stresses the importance of what the data shows:

“Single-family rent growth hit its sixth consecutive record high. . . . Annual rent growth . . . was more than three times that of a year earlier. Rent growth should continue to be robust in the near term, especially as the labor market continues to improve.”

What Does This Mean for You?

While it’s true home prices and mortgage rates are rising, so are monthly rents. As a prospective buyer, rising rates and prices shouldn’t be enough to keep you on the sideline, though. As the chart above shows, rents are skyrocketing. The big difference is, when you rent, that rising cost benefits your landlord’s investment strategy, but it doesn’t deliver any sort of return for you.

In contrast, when you buy a home, your monthly mortgage payment serves as a form of forced savings. Over time, as you pay down your loan and as home values rise, you’re building equity (and by extension, your own net worth). Not to mention, you’ll lock in your mortgage payment for the duration of your loan (typically 15 to 30 years) and give yourself a stable and reliable monthly payment.

When asking yourself if you should keep renting or if it’s time to buy, think about what Todd Teta, Chief Product Officer at ATTOM Data, says:

“. . . Home ownership still remains the more affordable option for average workers in a majority of the country because it still takes up a smaller portion of their pay.”

If buying takes up a smaller portion of your pay and has benefits renting can’t provide, the question really becomes: is renting really worth it?

Bottom Line

If you’re weighing your options between renting and buying, it’s important to look at the full picture. While buying a home can feel like a daunting process, having a trusted advisor on your side is key. Let’s connect to explore your options so you can learn more about the benefits of homeownership today.

Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

If you’re thinking about selling your house in 2022, you truly have a once-in-a-lifetime opportunity at your fingertips. When selling anything, you always hope for strong demand for the item coupled with a limited supply. That maximizes your leverage when you’re negotiating the sale. Home sellers are in that exact situation right now. Here’s why.

Demand Is Very Strong

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, Chief Economist for NAR, explains:

“Sales for the entire year finished strong, reaching the highest annual level since 2006. . . . With mortgage rates expected to rise in 2022, it’s likely that a portion of December buyers were intent on avoiding the inevitable rate increases.”

Demand isn’t expected to weaken this year, either. In addition, the Mortgage Finance Forecast, published last week by the Mortgage Bankers’ Association (MBA), calls for existing-home sales to reach 6.4 million homes this year.

Supply Is Very Limited

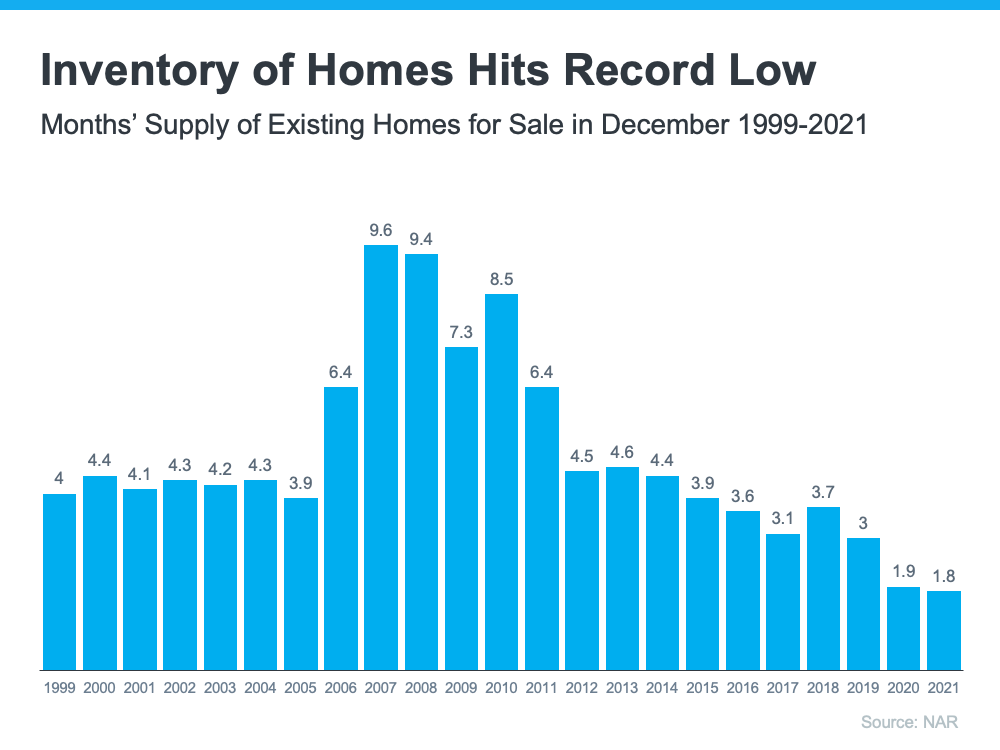

The same sales report from NAR also reveals the months’ supply of inventory just hit the lowest number of the century. It notes:

“Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.”

The reality is, inventory decreases every year in December. That’s just how the typical seasonal trend goes in real estate. However, the following graph emphasizes how this December was lower than any other December going all the way back to 1999.

Right Now, Sellers Have Maximum Leverage

As mentioned above, when there’s strong demand for an item and a limited supply of it available, the seller has maximum leverage in the negotiation. In the case of homeowners who are thinking about selling, there may never be a better time than right now. While demand is this high and inventory is this low, you’ll have leverage in all aspects of the sale of your house.

Today’s buyers know they need to be flexible negotiators that make very competitive offers, so here are a few areas that could tip in your favor when your house goes on the market:

- Competitive sales price

- Flexible closing date

- Minimal offer contingencies

Bottom Line

If you’re thinking of selling your house this year, now is the optimal time to list it!

Sellers: Don’t Wait Until Spring To Make Your Move

As you plan out your goals for the year, moving up to your dream home may top the list. But, how do you know when to make your move? You want to time it just right so you can get the most out of the sale of your current house. You also want to know you’re making a good investment when you buy your new home. What you may not realize is, that opportunity to get the best of both worlds is already here.

You don’t want to wait until spring to spring into action. The current market conditions make this winter an ideal time to move. Here’s why.

1. The Number of Homes on the Market Is Still Low

Today’s limited supply of houses for sale is putting sellers in the driver’s seat. There are far more buyers in the market than there are homes available, and that means buyers are eagerly waiting for your house. Listing your house now makes it the center of attention. As a seller, that means when it’s priced correctly, you can expect it to sell quickly and get multiple strong offers this season. Just remember, experts project more inventory will come to market as we move through the winter months. The realtor.com 2022 forecast says this:

“After years of declining, the inventory of homes for sale is finally expected to rebound from all-time lows.”

Selling now may help you maximize the return on your investment before your house has to face more competition from other sellers.

2. Your Equity Is Growing in Record Amounts

Current homeowners are sitting on record amounts of equity thanks to today’s home price appreciation. According to the latest report from CoreLogic, the average homeowner gained $56,700 in equity over the past 12 months.

That much equity can open doors for you to make a move. If you’ve been holding off on selling because you’re worried about how rising prices will impact your own home search, rest assured your equity can help fuel your next move. It may be just what you need to cover a large portion – if not all – of the down payment on your next purchase.

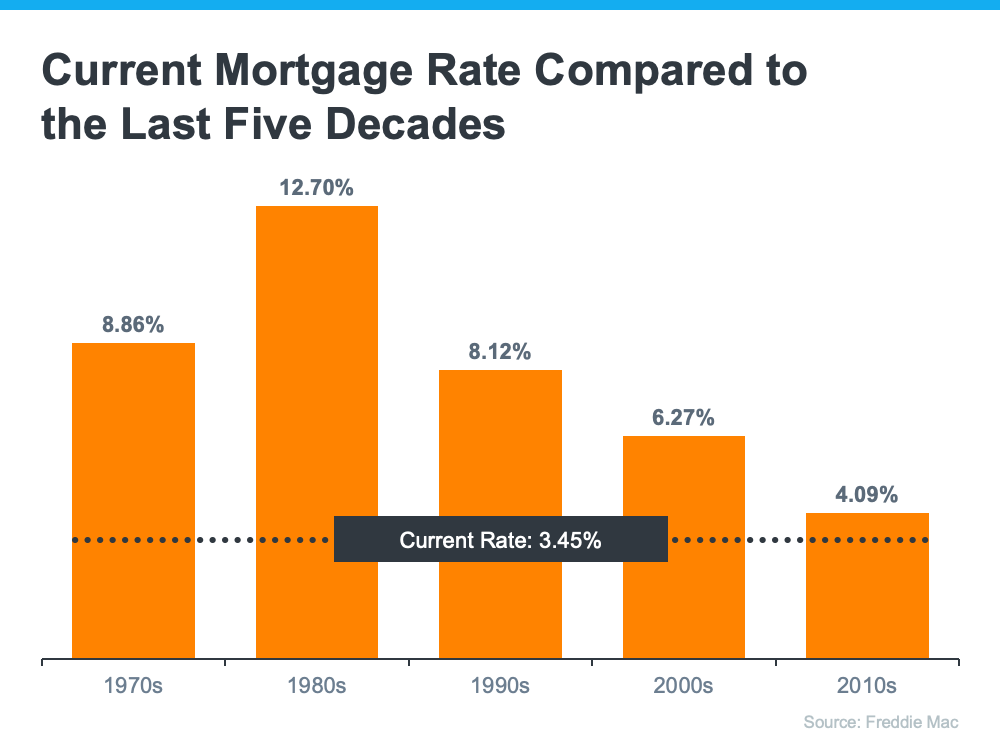

3. While Rising, Mortgage Rates Are Still Historically Low

In January of last year, mortgage rates hit the lowest point ever recorded. Today, rates are starting to rise, but that doesn’t mean you’ve missed out on locking in a low rate. Current mortgage rates are still far below what they’ve been in recent decades:

- In the 2000s, the average mortgage rate was 6.27%

- In the 1990s, the average rate was 8.12%

Even with mortgage rates rising above 3%, they’re still worth taking advantage of. You just want to do so sooner rather than later. Experts are projecting rates will continue to rise throughout this year, and when they do, it’ll cost you more to purchase your next home.

4. Home Prices Are Going To Keep Rising with Time

According to industry leaders, home prices will also continue appreciating this year. While experts are forecasting more moderate home price growth than last year, it’s important to note prices will still be moving in an upward direction throughout 2022.

What does that mean for you? If you’re selling so you can move into a bigger home or downsize to the home of your dreams, you want to consider moving now before rates and prices rise further. If you’re ready, you have an opportunity to get ahead of the curve by purchasing your next home before rates and prices climb higher.

Bottom Line

If you’re considering selling to move up or downsize, this may be your moment, especially with today’s low mortgage rates and limited inventory. Get in touch to get set up for homebuying success this year.

Achieving the Dream of Homeownership

Homeownership has long been considered the American Dream, and it’s one every American should feel confident and powerful pursuing. But owning a home is also a deeply personal dream. Our home provides us with safety and security, and it’s a place where we can grow and flourish.

Today, we remember the legacy of Dr. Martin Luther King, Jr. Many of us will remember his passion and determination for the causes he championed, including his famous “I Have a Dream” speech in 1963. As we reflect on his message today, it may inspire your own dream of homeownership. And if so, know you’re not alone. With a trusted real estate advisor at your side, you can begin your journey toward homeownership by answering the questions below.

1. Where Do I Start?

The process of buying a home is not one to enter into lightly. You need to decide on key things like how long you plan on living in an area, how much space you need, what kind of commute works for you, and how much you can spend.

Then, when you decide you’re ready to buy, you’ll need to apply for a mortgage. Your lender will look at several factors to determine how much you’re able to borrow, including your credit history. Lenders want to understand how well you’ve managed to pay your student loans, credit cards, car loans, and other past debts.

According to Freddie Mac:

“To get a rough estimate of what you can afford, most lenders suggest that you should spend no more than 28% of your monthly gross (pre-tax) income on your mortgage payment, including principal, interest, taxes and insurance.”

2. How Do I Save Enough for a Down Payment?

Speaking of how much you can afford, you’ll want to know what to save for a down payment. While the idea of saving for a down payment can be daunting, there are many different options and resources that can help.

According to Business Insider, automatic savings can bring you one step closer to achieving your target down payment:

“If you receive your paycheck as a direct deposit, you may want to arrange for your company to send a percentage of each check directly into a savings account for the down payment. . . . The automatic-savings strategy makes it so you don’t have to constantly remember to save money.”

Before you know it, you’ll have enough for a down payment if you’re disciplined and thoughtful about your process. And the best part is, you may need to save less for your down payment than you think. Your agent and lender can help you understand your options.

3. How Can I Reach My Financial Goals?

Another way to increase your savings is by sticking to a planned budget. If you’ve never budgeted before, there are tools available. For example, MoneyFit.org provides a budgeting worksheet you can use to create your own plan and five rules to follow when you’re saving. They recommend you:

- Identify Goals

- Record Expenses

- Record Earnings

- Compare and Calculate

- Fix Weak Spots

If you’re already budgeting, consider finding ways to tighten your spending a bit more to accelerate your journey to homeownership. After all, putting even a little extra into your savings each month can truly add up over time.

Bottom Line

As you set out to realize your dream of homeownership this year, know that it’s achievable with careful planning.

When Is the Right Time To Sell

![When Is the Right Time To Sell [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/01/13133345/20220114-MEM-1046x1950.png)

Some Highlights

- If you’re trying to decide when to list your house, the time is now. There are plenty of buyers eagerly waiting for your home to hit the market.

- The latest data indicates home showings are rising. There are more buyers than homes for sale right now. That means you’ll likely receive multiple offers, and your home won’t be on the market long.

- Today’s market favors sellers. If you’re ready to move, let’s meet to discuss the benefits you can expect when you sell this season.

What’s Going To Happen with Home Prices This Year?

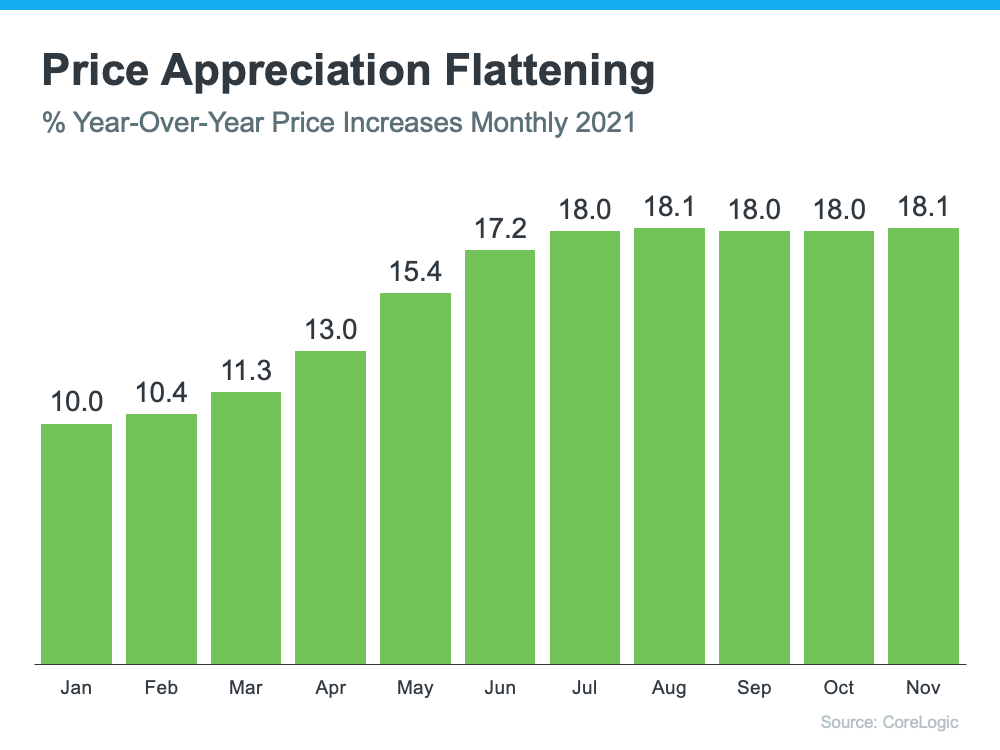

After almost two years of double-digit increases, many experts thought home price appreciation would decelerate or happen at a slower pace in the last quarter of 2021. However, the latest Home Price Insights Report from CoreLogic indicates while prices may have plateaued, appreciation has definitely not slowed. The following graph shows year-over-year appreciation throughout 2021. December data has not yet been released.

As the graph shows, appreciation has remained steady at around 18% over the last five months.

In addition, the latest S&P Case-Shiller Price Index and the FHFA Price Index show a slight deceleration from the same time last year – it’s just not at the level that was expected. However, they also both indicate there’s continued strong price growth throughout the country. FHFA reports all nine regions of the country still experienced double-digit appreciation. The Case-Shiller 20-City Index reveals all 20 metros had double-digit appreciation.

Why Haven’t We Seen the Deeper Deceleration Many Expected?

Experts had projected the supply of housing inventory would increase in the last half of 2021 and buyer demand would decrease, as it historically does later in the year. Since all pricing is subject to supply and demand, it seemed that appreciation would wane under those conditions.

Buyer demand, however, did not slow as much as expected, and the number of listings available for sale dropped instead of improved. The graph below uses data from realtor.com to show the number of available listings for sale each month, including the decline in listings at the end of the year.

Here are three reasons why the number of active listings didn’t increase as expected:

1. There hasn’t been a surge of foreclosures as the forbearance program comes to an end.

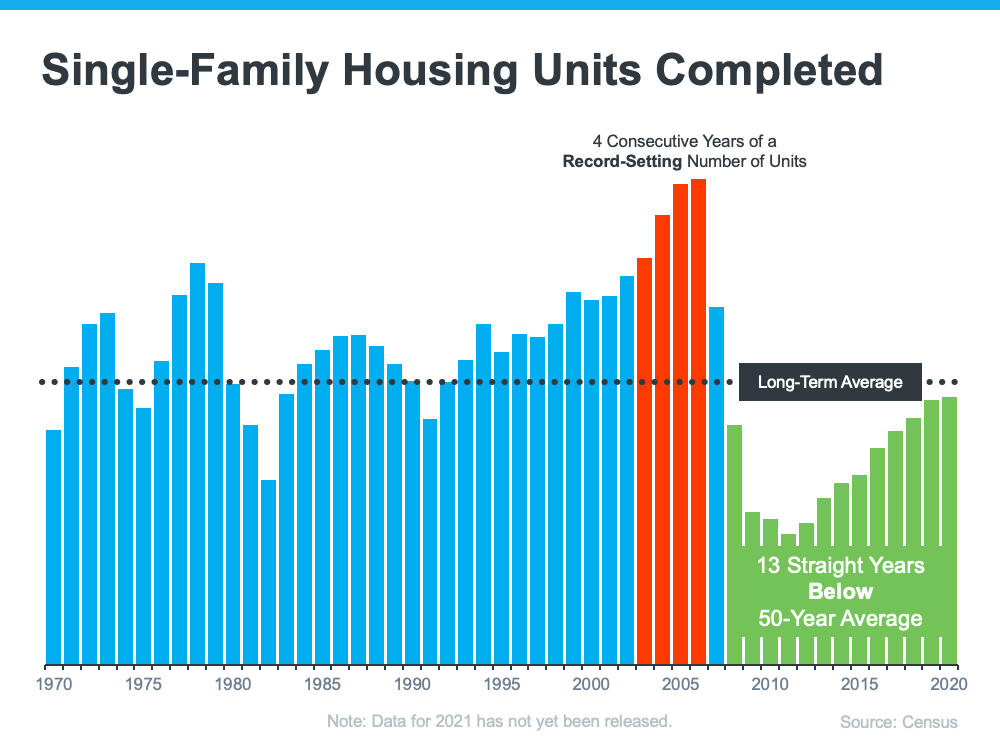

2. New construction slowed considerably because of supply chain challenges.

3. Many believed more sellers would put their houses on the market once the concerns about the pandemic began to ease. However, those concerns have not yet disappeared. A recent article published by com explains:

“Before the omicron variant of COVID-19 appeared on the scene, the 2021 housing market was rebounding healthily from previous waves of the pandemic and turned downright bullish as the end of the year approached. . . . And then the new omicron strain hit in November, followed by a December dip in new listings. Was this sudden drop due to omicron, or just the typical holiday season lull?”

No one knows for sure, but it does seem possible.

Bottom Line

Home price appreciation might slow (or decelerate) in 2022. However, based on supply and demand, you shouldn’t expect the deceleration to be swift or deep.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Why Your Home Inspection Matters [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/01/27130330/20220128-MEM-1046x2095.png)